Remark:

This is a two months old article but on 19th Jan 2026, new conditions for subsidy were released and hence most of what I have written below is not valid anymore. I will write a new article in the coming days. It is still very valuable article to understand the key stakeholders, but kindly don’t use these numbers anymore.

Key Takeaways

Start Date: 2026 (pending final EU approval)

Budget: €3 billion, running until 2029 or until funds are depleted

Payout: €3,000–€4,000 per vehicle (amount increases with number of children)

Eligibility: Taxable household income ≤€80,000–€90,000

Restriction: Strictly private purchases only. No company cars, no fleets

Powertrains: Applies to both BEVs and PHEVs (no differentiation)

What's Actually in This Subsidy Package?

Germany’s next EV subsidy program is officially taking shape.

After the sudden termination of the Umweltbonus in December 2023, which caused a -27% collapse in EV demand and sent multiple companies into job cuts or bankruptcy, the government now wants to reactivate private EV demand.

This new program is narrower, more targeted, and designed to support middle- and lower-income private households rather than corporate fleets.

The Subsidy Structure:

€3,000: taxable household income ≤ €80,000

€3,500: with 1 child (limit rises to €85,000)

€4,000: with ≥2 children (limit rises to €90,000)

What is Eligible?

BEVs & PHEVs: Both qualify equally.

Used Cars: Planned for "Phase 2" (expected late 2026).

Price Cap: Previously €45,000, but current drafts are silent. A cap may return for later.

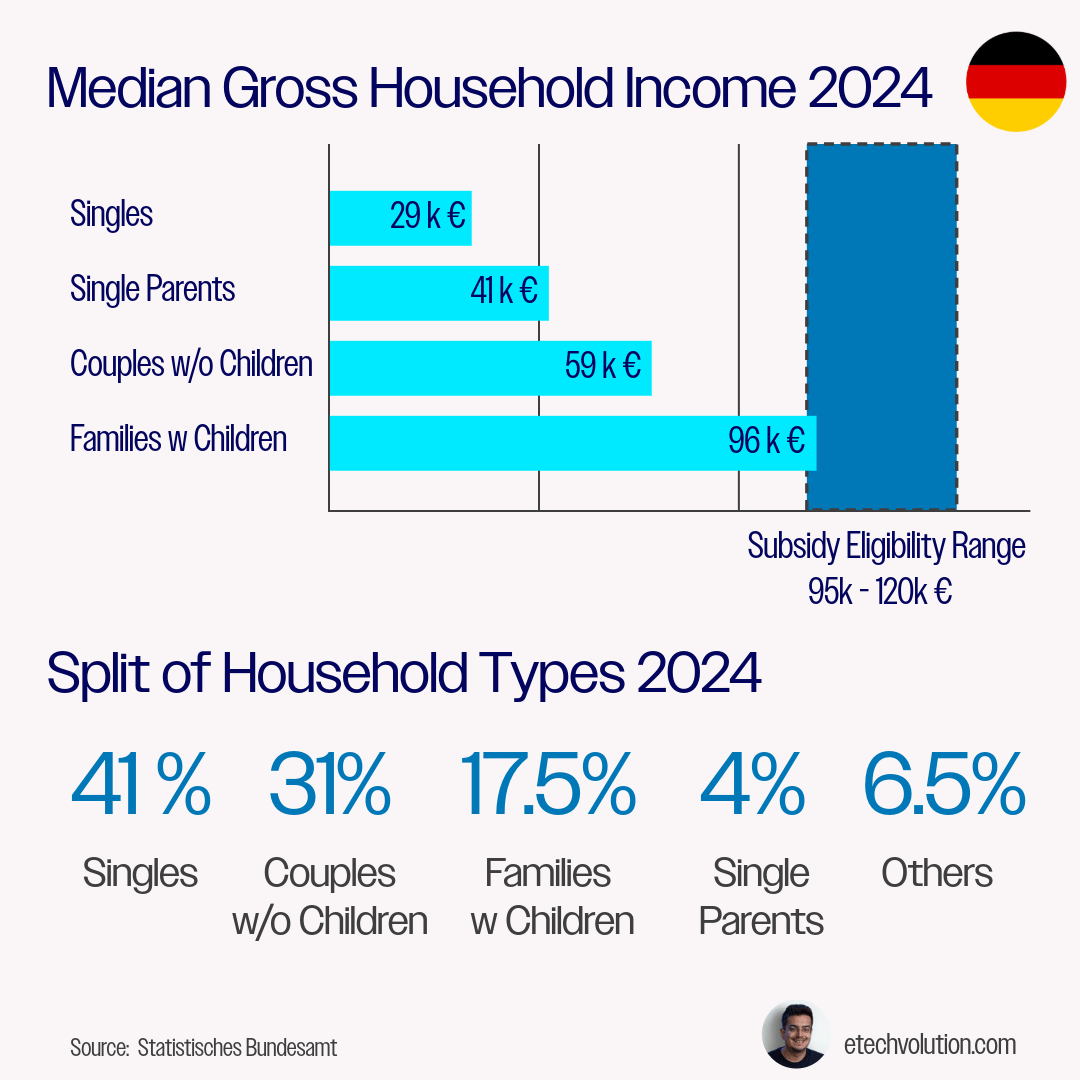

Who Actually Qualifies? The Income Reality Check

The income limit is based on taxable income (zu versteuerndes Einkommen), not gross salary.

Because taxable income excludes social contributions, insurances, and allowances, the thresholds correspond approximately to:

€95,000–€120,000 gross household income (€80,000–€90,000 taxable income)

Household Benchmarks (Median Gross Income)

Gross Income Benchmarks

Total Workforce: 46,000,000

Median salary: ~€52,000

Bottom 10%: ~€32,500

Bottom 30%: ~€43,000

Top 30%: ~€66,000

Top 10%: ~€97,000

(Source: Statistisches Bundesamt)

If we look at the professions and their median salaries.

>€90k: Doctors

€50k–€60k: Banking, Engineering, IT, Consulting, Marketing, HR

€37k-€50k: Sales, Skilled Trades, Healthcare, and Logistics

(Source: Stepstone)

Who Is In vs. Out

✅ IN: singles, single parents, most dual-income families, blue-collar workers

❌ OUT: top 5–10% earners, dual high-income couples

Bottom Line:

The program successfully targets the middle and low income class, not the wealthy.

What History Teaches Us: The 2022 / 2023 Subsidy Collapse

Market Response to Subsidy Removal

Year | BEV | PHEV | BEV Market Share % | PHEV Market Share % | BEV Private % | PHEV Private % |

|---|---|---|---|---|---|---|

2021 | 355,961 | 325449 | 14% | 12% | 50% | 33% |

2022 | 470,559 | 362093 | 18% | 14% | 50% | 32% |

2023 | 524,219 | 175724 | 18% | 6% | 43% | 21% |

2024 | 380,609 | 191905 | 14% | 7% | 36% | 18% |

2025* | 434,627 | 248706 | 18% | 11% | 36% | 21% |

*till October 2025

(Source: KBA)

Three patterns:

PHEV Crash: Lost subsidy in Dec 2022. Registrations dropped ~51% in 2023.

BEV Crash: Lost subsidy in Dec 2023. Registrations dropped 27% in 2024.

Recovery: In just one year, BEV registrations bounced back and are expected to grow 35% in 2025.

The Lesson:

Subsidy certainty matters more than subsidy amount. The market can adapt to lower subsidies, but cannot adapt to sudden elimination.

How Long Will €3 Billion Really Last?

Officially, the subsidy runs until 2029. Realistically, it won’t. This is actually a good sign, it means the budget is based on realistic market volumes. However, the inclusion of PHEVs and used cars will drain this pot quickly.

Capacity: At €3k–€4k per vehicle, this budget funds roughly 750,000–850,000 cars.

Forecast: Based on historical private market volumes, the money likely runs out by early to mid 2028.

The only way this runs to 2029 is if demand stays unexpectedly low, which goes against all historical patterns.

Three Dynamics Decides Which Technology Will Win

Equal subsidies for BEVs and PHEVs create a unique moment: the technology winner won't be decided by government policy. It will be decided by three groups who control the customer experience.

The Demographics:

Under 35s: Open to tech, adaptive, willing to learn. (This group scaled EVs in China).

Over 40s: Often more conservative and risk-averse. They will be among the prime audience for this subsidy. They will lean toward PHEVs if they don’t understand how emobility works, if hurdles to BEVs seem too high, and hence would require more convincing.

A. Dealerships: The Gatekeepers

Germany is a conservative market. Cash is king. Trust is built face-to-face.

Familiarity with Technology:

Many salespeople have spent decades selling combustion engines. They know the tech. BEVs require learning a new ecosystem (charging curves, apps, range).

The "Commission" Trap:

Sales jobs usually are structured around fixed income + performance commission.

I’ve spent 9 years as a sales manager in Germany’s automotive sector. Before that, as a student, I sold city tour tickets to tourists on the streets of Berlin for 2 years, competing with 3-5 other sellers in real-time. I know what desperation sales looks like. I know the temptation to take the easy route to hit a target.

If a dealership salesperson fails to sell a BEV multiple times because they lack the training or confidence, they will naturally shift to selling PHEVs. Not because they hate BEVs, but because their income depends on closing deals.

The Test:

Walk into a dealership in Q1 2026. The confidence with which a dealer answers "ID.4 or Tiguan eHybrid?" will determine the success of this subsidy.

What OEMs Must Do:

If manufacturers want BEV volume, they need to invest in dealer training. Most importantly, bring the CPOs in this training session with dealers as well, so that everyone understands how the ecosystem works and how to convince the potential customers.

B. CPOs: The Pricing Problem That Kills Adoption

The subsidy targets people who likely do not have a garage or wallbox. They will depend heavily on public charging. Here is where the industry is currently failing them.

The “Ad-Hoc and Roaming” Penalty

New adopters don’t want 10 different apps. They want to tap a card or enter a pin using their credit card / EC Card, just like buying groceries in a supermarket or fueling their car at a gas station. The prices with card or cash are exactly the same. It is frictionless and understood by everyone.

No one spends time in front of oranges or fuel station, swapping apps to find the best deal and we need the same mindset in E-mobility as well.

But sadly, the CPOs in Germany currently punish anyone using the most widely used payment method. I analyzed pricing across 5 major non-Tesla CPOs covering ~33% of Germany’s public DC chargers.

Subscription (Charging at Own Network): ~€0.39–0.54/kWh

Ad-Hoc / Credit Card: ~€0.69–0.84/kWh

Roaming: up to €0.79/kWh even if the operator’s own ad hoc price is €0.47/kWh

Why The Prices of Public EV Charging are Extremely Important

I drove a VW ID.5 for 38,000 km over a period of 2 years. I used to frequently log my driving and charging sessions and payment methods to understand the technology better. This helped me in selling the EV chargers, as I understood the driving profiles and business case of my potential customers.

I have tracked my energy consumption across city and highway driving, but also in various terrains and conditions, e.g., perfect summer in Germany, Netherlands, Austria (Mountains), and winter in Germany and Switzerland (Mountains).

Now let me paint a very clear picture, where we stand today, while comparing public EV charging and fueling prices per 100 km in Germany.

Average real-world consumption: ~21 kWh/100 km at Autobahn speeds

BEV @ €0.10 → €2.1 (Home charging with solar panel)

BEV @ €0.35 → €7.3 (Home charging without solar panel)

BEV @ €0.49 → €10.3

BEV @ €0.59 → €12.4

BEV @ €0.69 → €14.5

BEV @ €0.79 → €16.6

Petrol hybrid → €12.6–€13.4 (7.5 - 8 L/100 km)

Above €0.60/kWh, BEVs lose cost advantage over petrol hybrids.

The Psychology of Cost:

EVs win on maintenance, but psychology is irrational. Maintenance is an annual cost; charging is a "visible" weekly pain on the wallet. We notice the €40 charging session much more than the once-a-year maintenance. To win the mass market, EVs must win at the “pump” (the charger), not just in the workshop.

Another Example: Think of your least favorite relative visiting: would you prefer they visit for 12 days once a year, or one day every single month? You notice the frequency. 😅

Warning for CPOs: If you keep ad-hoc pricing above €0.59/kWh, you break the business case for private buyers. They will buy PHEVs and drive on petrol instead.

Worse: If PHEVs dominate, they will clog DC fast chargers (charging at only 40kW) while blocking BEVs that could charge at 150kW+. This kills your revenue per minute.

The Solution: Drop ad-hoc pricing to €0.49/kWh. Stop punishing credit card users. Fix and improve the roaming prices, or else no one really wins.

C. How to Win: Make the Industry Feel the Pain

EVs are objectively better, more efficient, fewer parts, lower maintenance. But physics doesn't sell. Experience sells.

The History Lesson In 1903, the President of the Michigan Savings Bank famously advised Henry Ford’s lawyer not to invest in the Ford Motor Co., saying:

"The horse is here to stay but the automobile is only a novelty—a fad."

Why? Because the horse was frictionless. The car only won when it became easier and provided much more value than the horse. EVs are currently an alternative to an existing technology and alternatives must be obviously better to win. To win, the friction must disappear.

Now looking specifically at E-mobility, the problem is that many people working are disconnected with the ground realities.

Some of them are still not driving EV

Charge with fleet cards

Charge at home

Never feel the need to pay with credit card

Hear customers through dashboards and CRM tools instead of first hand experience and discussion

Also, if they own a private Tesla, they will also not feel the pain, as they are accustomed to best in class navigation, charging at superchargers with the best prices.

My Proposal to Leadership: The "Painful Test"

To fix EV adoption and increase utilization, companies must force their teams, from CEOs to service engineers, to experience what customers experience. Here is my suggestion.

The 4-Week Test:

Drive a Non-Tesla EV for 3 weeks, and Tesla for 1 week

No home charging. Public charging only.

No fleet cards. Pay like a regular customer.

Try at least 6 different CPOs, install all major CPO apps

Track every payment option offered (card, app, roaming, QR)

Find the cheapest app manually for every charge session

Log every failed session, app bugs and every "out of order" stall.

Only then will you understand why a "satisfied" customer on a PowerPoint slide might actually be a frustrated driver ready to switch back to diesel.

Finally: Always Give a Second Thought Looking at Statistics

If you follow me, you know I love charts. But stats can be skewed and therefore needs to be looked at very carefully.

90% passing accuracy for a midfielder in football could mean an elite level player or incredibly limited and passive player, who instead of bringing the ball forward and create goal scoring chances, plays the safe pass to sides or back to defenders under pressure.

Currently 65% of BEVs in Germany are registered as company cars. Also there are studies showing that once people get EVs, they rarely switch back.

But here is the fine line we need to understand. I have talked to many people driving company cars. Company car holders having a wallbox at home, love EVs and will never switch. But I've met drivers with company EVs who'd never buy one privately.

Why?

"I don't have time for apps.

Pricing is insane without a fleet card."

These people will be in the subsidy targets. If the experience doesn’t improve, they’ll take €3,000 and buy a PHEV.

My Take

Germany’s new subsidy is well targeted:

It supports the middle class, avoids subsidising fleets, and gives families meaningful support.

But whether BEVs or PHEVs win depends on:

How dealers position BEVs vs PHEVs in those critical first conversations

Whether CPOs bring pricing down to a level where running costs clearly beat petrol

Questions for you:

Out of the ~800,000 vehicles this program will fund, what is your prediction for the split?

BEVs: ___ %

PHEVs: ___ %

Reply with your estimates. I’m curious to see your take.

Also do you think, there dealerships might be asked about depreciation values of EV? If yes, what is the best take on it to alleviate concerns?

Want Ground Reality, Not PowerPoint Slides?

I work with on the ground intelligence from 9 years working in the Automotive sector. From major OEMs, to EV experience and hundreds of charging site conversations and logging personally a lot of charging sessions. Through my own socials and content creation for over 3 years, I have been connected with automotive and emobility community as well.

If you need a reality check for your strategy or want to improve your offering, let's talk.

Services:

Competitive positioning for charging networks/EV products

Market entry analysis for Germany's subsidy landscape

Pricing strategy to capture private buyers

Social media marketing to reach EV buyers

Project based consulting, single deepdives or ongoing support.

Reach me at 📧 [email protected]

That is it for today.

Let me know your thoughts? Did you like it and found it insightful? I really appreciate your feedback

Subscribe, if you haven’t already, to never miss these insights, as I am just getting started. 😄

Haseeb - till next time!