Key Points

Tata Motors announced a €3.8 billion acquisition of Iveco's commercial vehicle business, aiming to triple its CV revenue and unlock European electric truck technology.

The deal is contingent on the sale of Iveco's defense unit to Leonardo for €1.7 billion by Q1 2026, clearing the path for full commercial integration by mid-2026.

The combined entity generates, as of today, €22 billion in annual revenue and Tata expects to achieve a 16% return on invested capital by FY 2028, significantly above its 11.5% cost of capital.

Strategic Context

For over decades, Tata Motors has dominated India's commercial vehicle market while steadily building presence across emerging economies. But it lacked one critical asset: meaningful access to Europe, the world's most advanced regulatory landscape for heavy duty electric vehicles.

This acquisition would change everything. Tata doesn't just gain a European footprint, it inherits a legacy OEM with 36,000 employees globally and operational depth that realigns its commercial vehicle strategy for the next decade.

Deal Structure & Financial Architecture

Tata is acquiring Iveco's commercial vehicle business for €14.10 per share. Tata expects to achieve a 16% return on invested capital by FY 2028, significantly above its 11.5% cost of capital.

The combined Tata Iveco commercial vehicle business (excluding defense business), as of today, generate €22 billion annually across 540,000 vehicles. With this acquisition, the revenue of Tata’s commercial vehicles business will triple.

Geographic & Operational Synergies

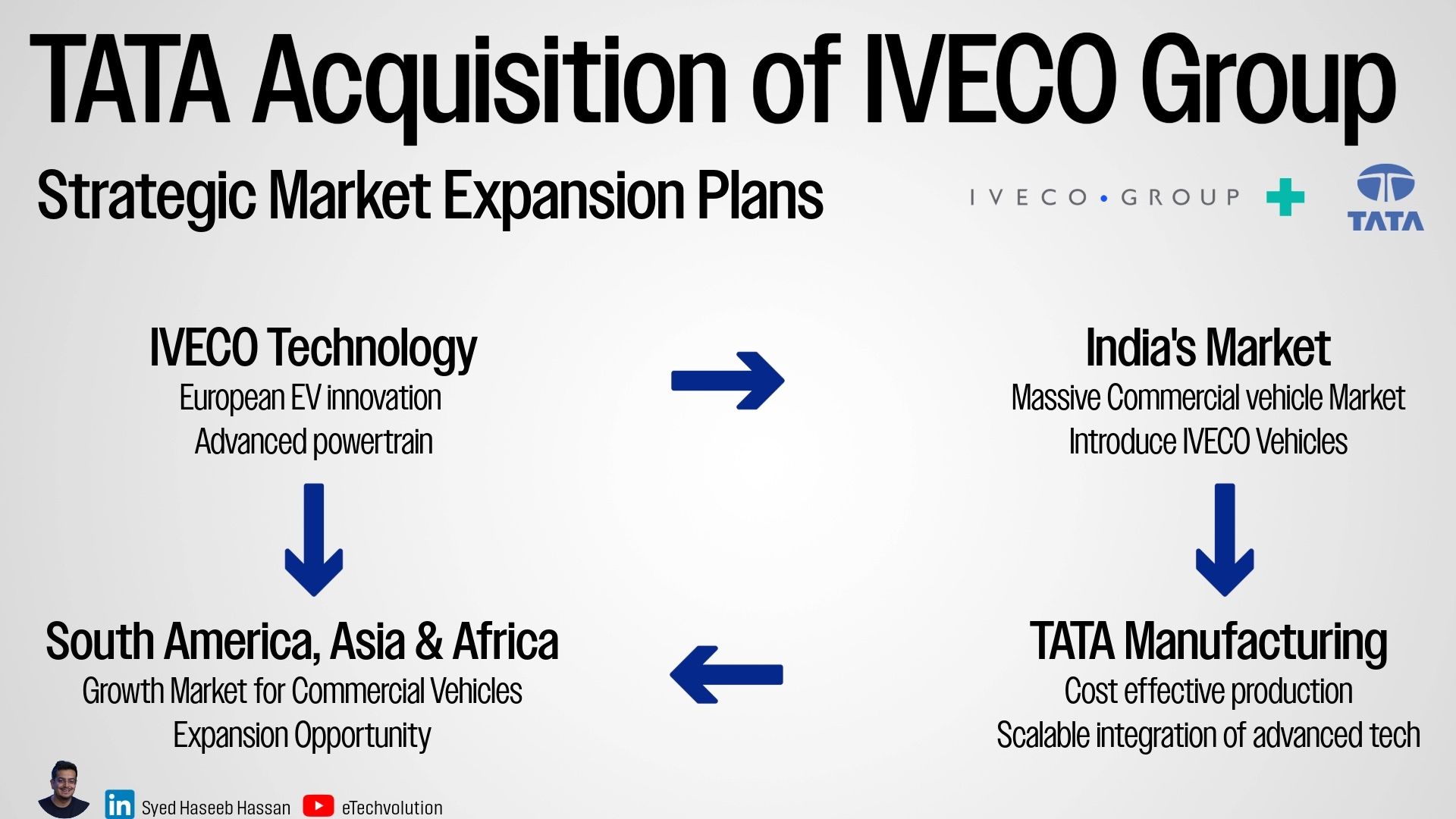

The geographic complementarity represents the deal's most compelling aspect:

Iveco: Generates 75% of revenue from Europe, where Tata had minimal penetration

Tata: Dominates India and emerging markets, where Iveco lacked scale

This creates immediate high leverage opportunities:

European tech → Indian scale: Iveco's electric truck and bus technology accessing India's massive commercial vehicle market

Indian efficiency → Global expansion: Tata's cost-optimized platforms expanding across South America, Asia, and Africa

Consolidated R&D: Streamlining parallel developments in electrification, powertrains, and vehicle connectivity

Technology Transfer & Mutual Strengthening

What Tata Gains:

European electric truck development capabilities

Advanced powertrain and connectivity technology

Regulatory expertise for the world's most stringent EV markets

High-quality European manufacturing standards

What Iveco Gains:

Tata's world class cost engineering capabilities

Proven emerging market product development expertise

Access to India's rapidly growing commercial logistics sector

Scale manufacturing experience across diverse markets

Political Considerations & Strategic Structure

The Italian government endorsed the deal as a "quality foreign investment," but they would closely follow the deal, to make sure that Tata preserves Iveco's brand identity, workforce, and production footprint.

Importantly, the deal is contingent on the successful sale of Iveco’s defense unit to Leonardo for €1.7 billion, which is expected to close by Q1 2026. Only after that sale is completed will Tata proceed with the acquisition of Iveco’s commercial vehicle operations.

This clean separation of military assets effectively decouples national security risks from the commercial integration and ensures regulatory compliance. Leonardo is expected to subsequently transfer the defense unit to Germany’s Rheinmetall.

Industry Implications: A New M&A Playbook

This transaction establishes a potentially transformative template for automotive M&A in the electric vehicle era:

Prioritize technology access over traditional brand or manufacturing scale

Seek regulatory expertise rather than just production capacity

Target complementary markets with minimal operational overlap

Maintain financial discipline and clean asset structures

If successful, Tata's approach could become the blueprint for how automotive companies scale in the electrification transition.

Execution Risks & Critical Success Factors

Despite strong strategic logic, execution challenges remain significant:

Cultural integration: Successfully merging Indian and Italian corporate cultures across 36,000 employees

Technology localization: Adapting European EV technology for emerging market applications and cost structures

Regulatory navigation: Managing complex EU commercial vehicle compliance post-acquisition

Economic timing: Executing integration during potential macroeconomic volatility

The timeline through mid-2026 provides adequate integration runway, but ultimate success depends on post-acquisition execution rather than deal architecture.

Conclusion

This acquisition represents a calculated bet on the future structure of the global commercial vehicle industry. By prioritizing technological capability, regulatory expertise, and market agility over pure manufacturing scale, Tata may have identified the optimal growth strategy for the electric vehicle era.

In an industry where legacy players struggle with stranded combustion engine assets, Tata-Iveco can architect for electric-first operations. Sometimes being strategically positioned matters more than being biggest.

The next 24 months will determine whether this approach delivers the promised synergies and establishes a new model for automotive consolidation in the electrification age.

📚 Sources & References

Handelsblatt – Tata übernimmt Iveco und plant Europa-Offensive (German)

📩 To stay ahead of the eMobility curve and automotive news, subscribe to my newsletter, follow me on my socials (Linkedin, Youtube, Podcasts etc.) to get latest insights on emobility, automotive news and global market strategy.

Haseeb