Key Points

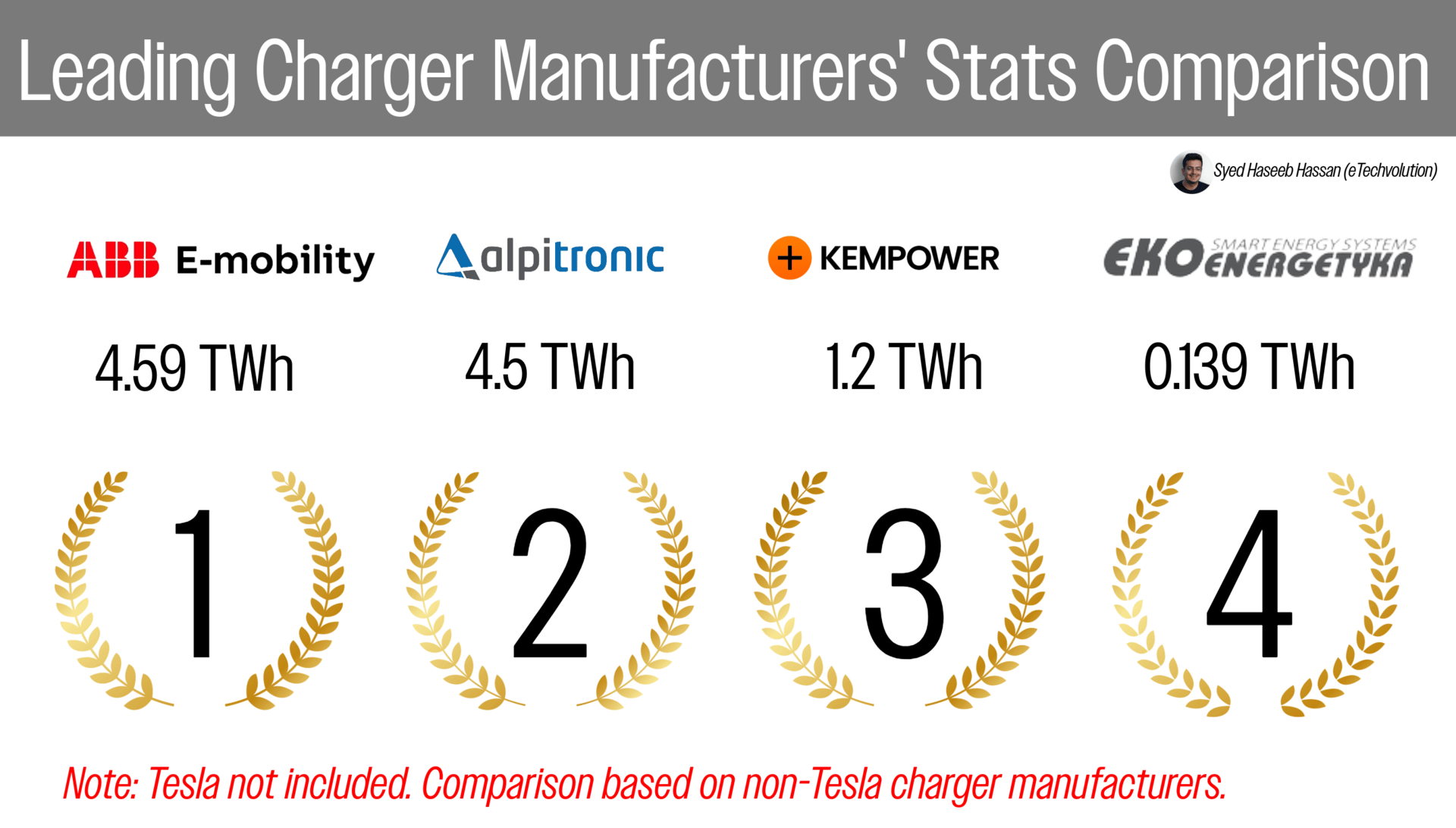

ABB E-mobility and Alpitronic have established themselves as the dominant forces, each delivering over 4.5 TWh of energy by September 2025.

Kempower demonstrates the strongest expansion trajectory with 22% energy growth, leveraging their specialized focus on depot charging solutions for commercial fleets.

Ekoenergetyka maintains stable operations at a smaller scale.

Leading EV Charger Manufacturers’ Stats: ABB E-mobility, Alpitronic, Kempower & Ekoenergetyka

Transparency is slowly becoming the new standard in eMobility. Over the past year, several leading charger manufacturers have started publishing their performance data, a welcome shift that helps the industry benchmark real progress.

In this update, we take a closer look at the four largest non-Tesla DC fast charger manufacturers: ABB E-mobility, Alpitronic, Kempower, and Ekoenergetyka. Together, they are driving a significant portion of the world’s charging infrastructure rollout.

Market Position Analysis (September 2025)

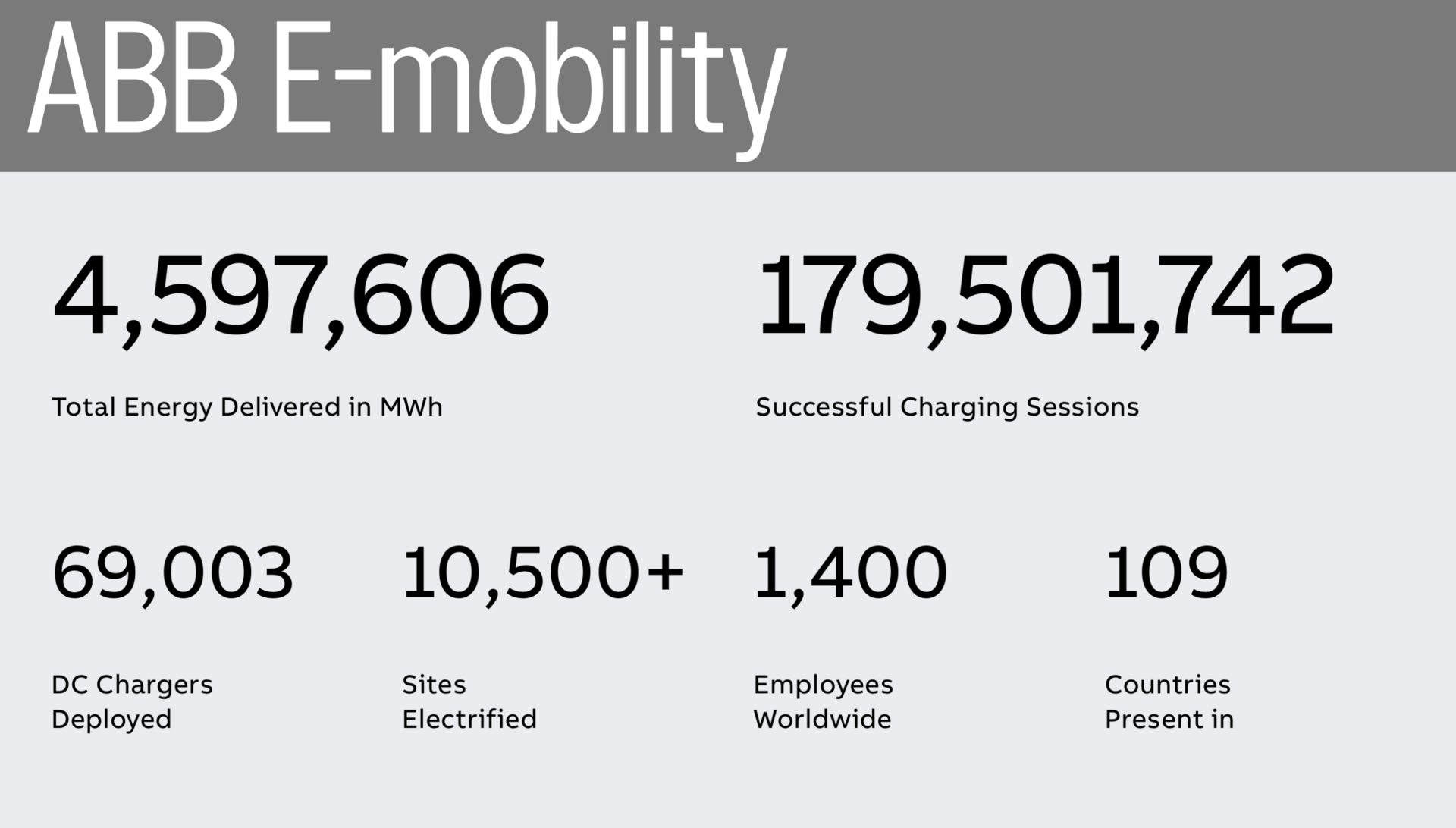

1. ABB E-mobility - Market Leader

Energy delivered: 4.59 TWh (increased from 4.1 TWh in July)

Infrastructure scale: Approximately 69,000 DC chargers deployed worldwide

Usage volume: 179.5 million charging sessions (up from 171.1 million in July)

Global reach: Operations across 109 countries

ABB maintains its position through sheer scale and geographic penetration, with the largest deployed charging network outside of Tesla.

ABB E-mobility: Charging Stats (Sep 2025)

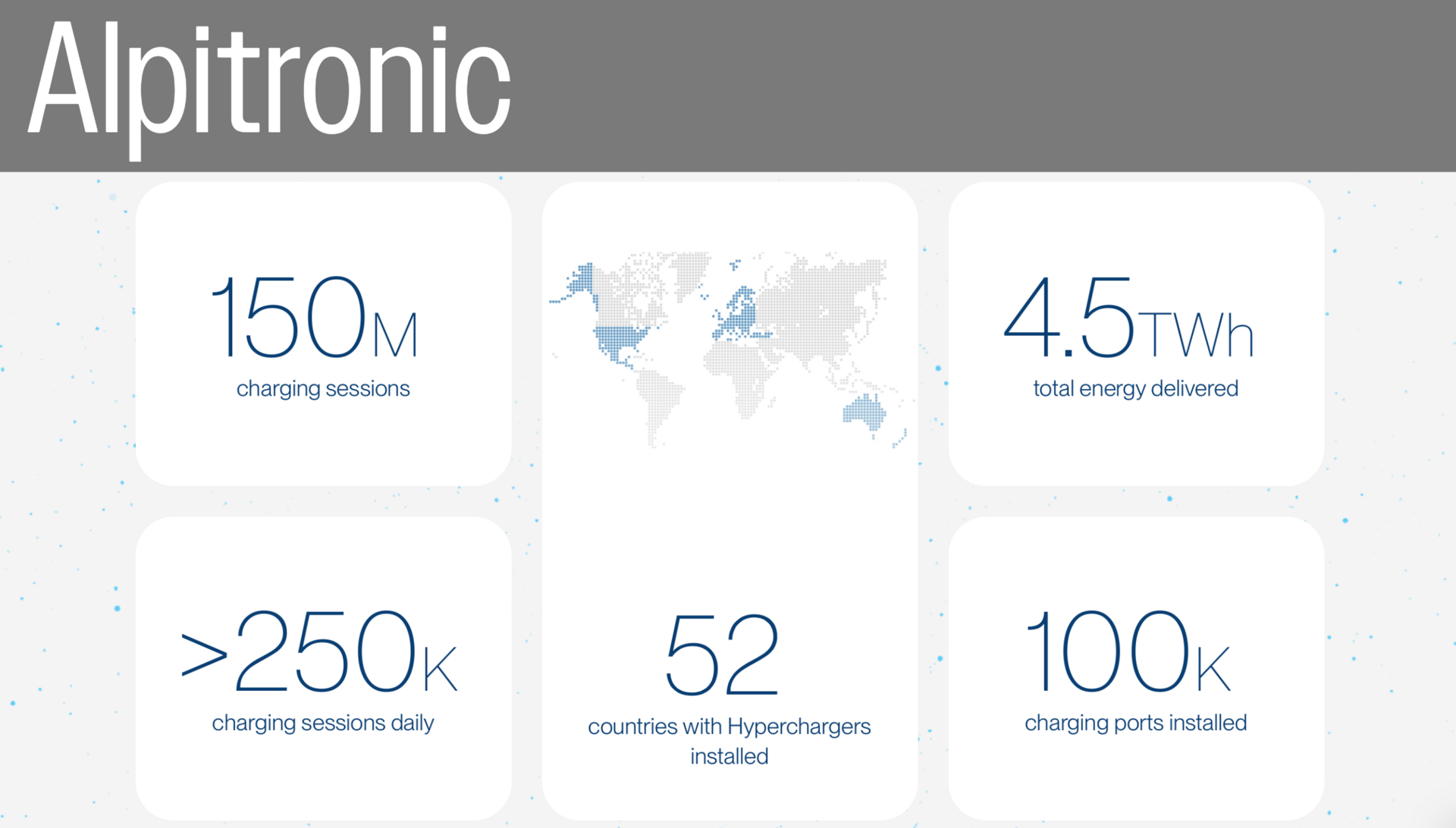

2. Alpitronic - The Rising Challenger

Energy delivered: 4.5 TWh (increased from 4.0 TWh)

Infrastructure scale: Approximately 44,000 chargers deployed (significant expansion from 37,500 in July)

Usage volume: 150 million charging sessions (up from 130 million)

Global reach: Present in 52 countries

Alpitronic shows the most aggressive expansion in charger deployment, indicating substantial investment in infrastructure scaling.

Alpitronic: Charging Stats (Sep 2025)

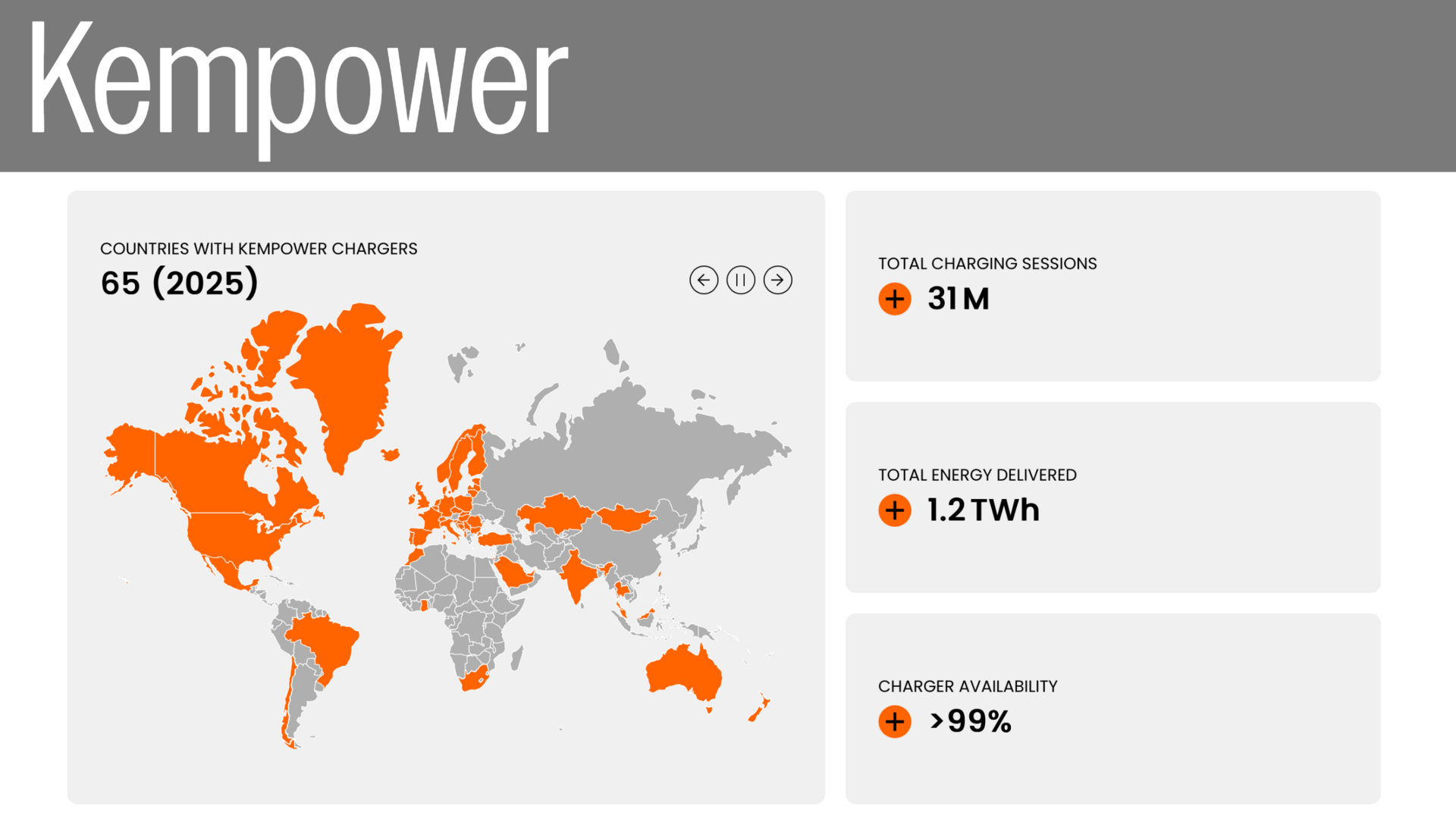

3. Kempower - The Growth Leader

Energy delivered: 1.2 TWh (increased from 0.98 TWh)

Usage volume: 31 million charging sessions (up from 26 million)

Global reach: Operations in 65 countries

Strategic advantage: Specialized focus on depot charging for buses and commercial vehicles

Despite smaller absolute numbers, Kempower's growth rate outpaces all competitors, suggesting effective market positioning in high value segments.

Kempower: Charging Stats (Sep 2025)

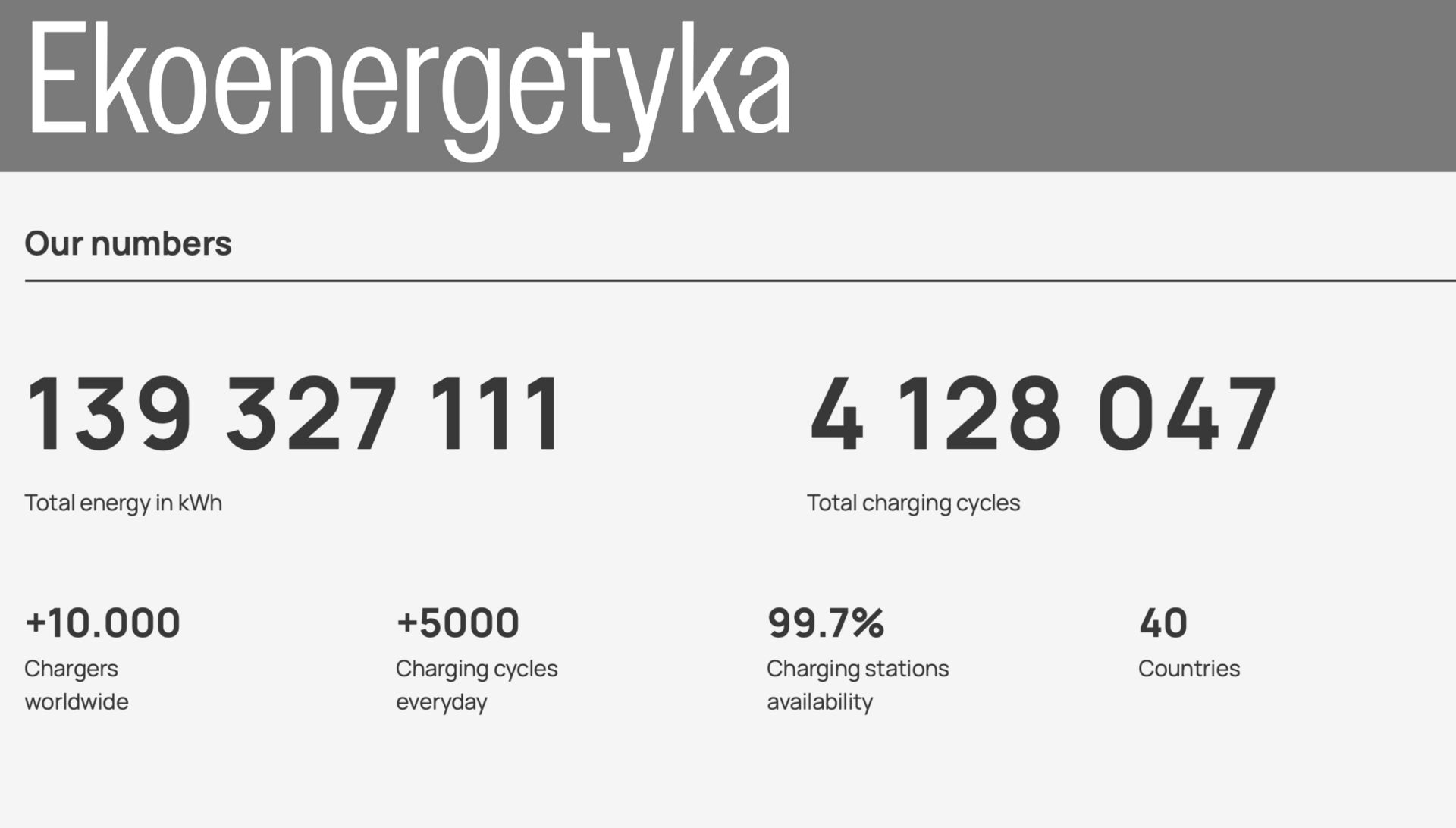

4. Ekoenergetyka - The Regional Specialist

Energy delivered: 0.139 TWh (marginal increase from 0.138 TWh)

Infrastructure scale: Approximately 10,000 chargers

Usage volume: 4.13 million charging sessions

Global reach: Present in 40 countries

Ekoenergetyka represents the regional approach to market development, maintaining steady operations within their established territories.

Ekoenergetyka: Charging Stats (Sep 2025)

Industry Implications

This data transparency trend signals a maturing industry where performance metrics are becoming standardized benchmarks. The willingness of manufacturers to publish these figures suggests growing confidence in their market positions and a shift toward more competitive, data-driven business practices.

The emergence of clear market tiers, from ABB's massive scale competing neck and neck with Alpitronic (who appears to have momentum for the coming years), to Kempower's specialized growth strategy, indicates that the industry is moving beyond the early experimental phase toward established competitive dynamics.

Note: Tesla Supercharger network data is not included in this comparison as Tesla maintains different reporting standards.

What's your prediction?

Who will be leading the charts by end of 2025? And any wild guesses on what the energy delivered numbers will look like for each player by year-end?

Join the conversation:

Share your predictions in the comments below

What factors do you think will be most decisive in the final quarter?

Which company's strategy resonates most with your view of the industry's direction?

That's it for today. If you found this useful, or have other examples from your own driving or data analysis, I'd love to hear them. And if you want more of these grounded, real world takes on EV infrastructure, charging, and pricing, make sure to follow me, and subscribe to my newsletter and also my YouTube channel.

Let's keep pushing the conversation forward.

Haseeb