Key Points

Shell's weekend pricing experiment in Germany (€0.29/kWh for subscribers vs usual €0.55-0.65/kWh) demonstrates massive price elasticity in EV charging demand.

Pfalzwerke's pricing test (down to 0.07 €/kWh) resulted in 250% utilization increase from 6% to 21% in a single day, proving that strategic pricing can dramatically boost charging infrastructure efficiency.

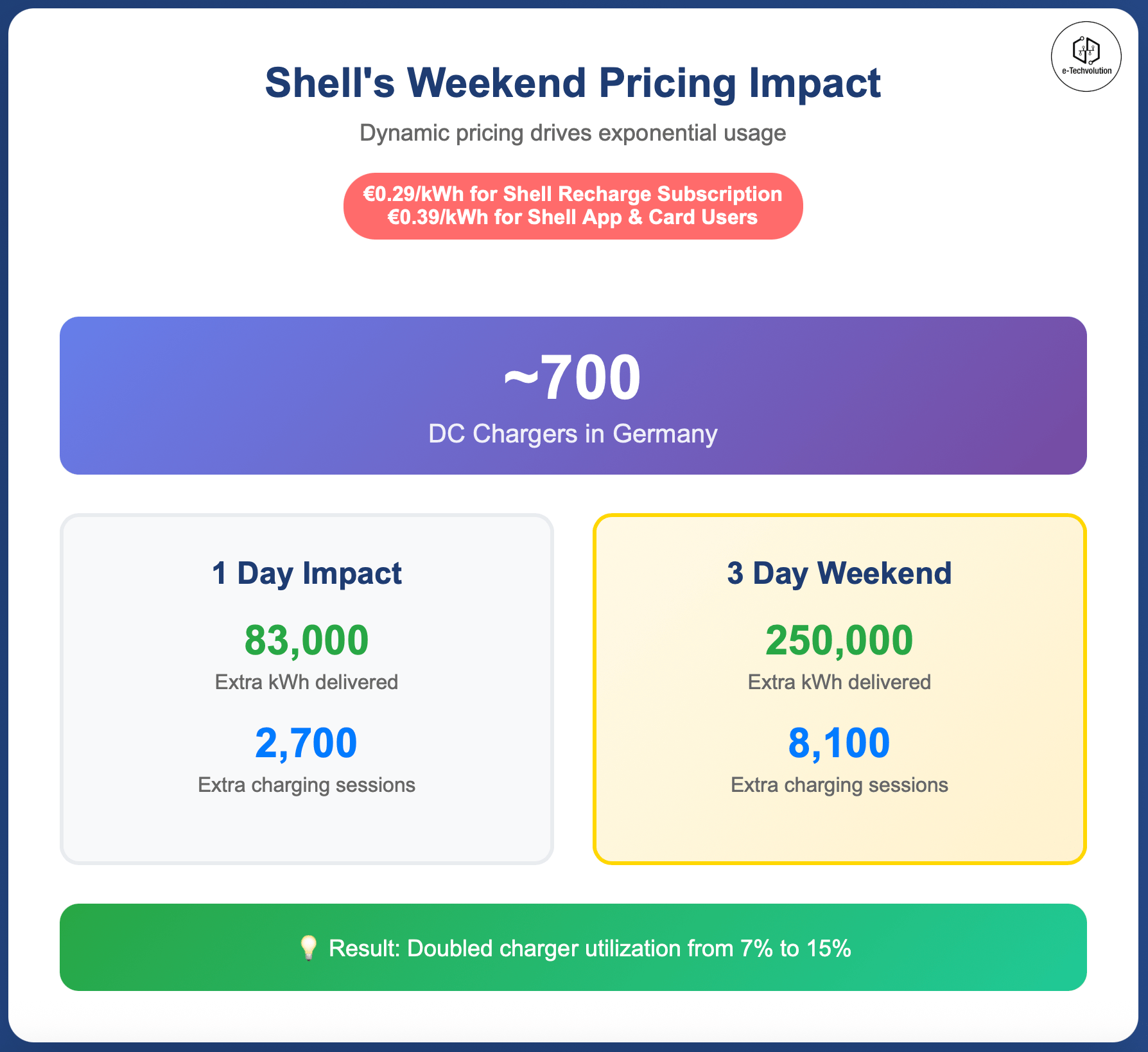

My analysis estimates Shell's weekend promotion could generate 8,050 extra charging sessions and €75,000-100,000 in additional revenue over three days, doubling charger throughput despite lower margins.

Context

Last weekend (1st August - 3rd August), Shell offered really attractive pricing in Germany for their Shell Chargers, €0.29/kWh for Shell Recharge subscribers and €0.39/kWh for app and card users.

While this may seem like a short term promotion, it's actually a strategic signal as Shell tests their dynamic pricing pilot.

Shell Official Promo

The Data Speaks Volumes

Shell is testing demand elasticity, and based on similar examples, I predict exponential usage uplift when pricing aligns with consumer behavior. We've seen this pattern before.

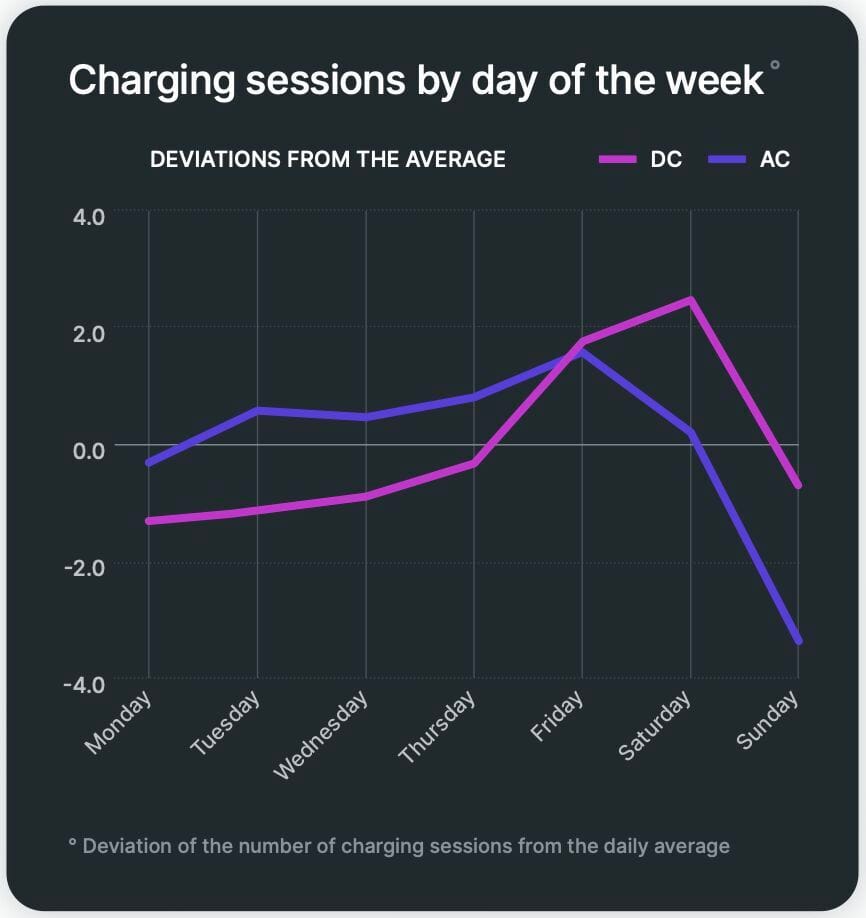

Elvah's charging data of public charging points in Germany, shows DC usage spikes on weekends, while AC charging dominates weekdays (likely due to workplace charging).

Public Charging Sessions in Germany - AC vs DC (elvah)

The most compelling case study comes from Pfalzwerke's one day test last year: dropping prices to just €0.07/kWh across 33 sites triggered a 250% increase in utilization, jumping from 6% to 21%.

That's not marketing hype, that's operational leverage.

Pfalzwerke Case Study (elvah)

Applying the Math to Shell's Network

According to my analysis, applying the same elasticity to Shell's network of approximately 700 DC chargers, roughly 1600 charge points, in Germany shows significant potential. Even under a very conservative assumption, starting from just 7% baseline utilization, this offer likely pushed weekend usage to at least 15%, which translates to:

8,050 extra charging sessions over three days

250,000 additional kWh delivered

Potentially €75,000-100,000 in new revenue

Yes, the margins per kWh shrink, but charger uptime and throughput double.

My Conservative Estimate

The Bigger Picture

This represents the kind of data-driven pricing strategy that can fundamentally shift the economics of EV infrastructure. It's not about racing to the bottom, it's about activating dormant demand during leisure travel windows and building stickier user habits.

What's your experience with dynamic pricing? Do you utilize it when available, and could this be the missing lever to make public fast charging profitable?

📚 Sources & References

elvah – EV Charging Reports

📩 To stay ahead of the eMobility curve and automotive news, subscribe to my newsletter, follow me on my socials (Linkedin, Youtube, Podcasts etc.) to get latest insights on emobility, automotive news and global market strategy.

Haseeb