For the last three to four years, I've been deeply fascinated by China.

I followed its electric vehicles, software defined cars, and the way Chinese manufacturers compressed development cycles that traditionally took Western OEMs 4-5 years into barely 18-24 months. The prices looked unreal. The innovation looked unstoppable.

Xiaomi vehicles took over global headlines in just two years, matching or exceeding Porsche Taycan performance metrics while priced at ~30% of the Taycan. BYD was the first to present megawatt charging in passenger cars with the Han L and Tang L, then later showcased the fastest production car, the Yangwang U9 (Xtreme) hitting 496 km/h (308 mph). NIO made battery swapping look seamless.

Like many others, I focused on the products. And like many others, I missed the system behind them.

When you only look at what China builds, you miss why it is behaving the way it does.

When the Numbers Stopped Fitting the Narrative

What broke my tunnel vision wasn't another product launch. It was attending Dr. Angela Wang's (SVP - Neusoft Corporation) Chinese market overview at IAA, combined with the data I recently studied.

Chinese Regulators are Trying To Control The Price War - Neusoft Corporation (IAA 2025)

A short summary:

BYD cut domestic prices by roughly 32% between 2023 and the first half of 2025.

227 different models slashed prices in 2024 alone.

These were not incremental competitive adjustments. They were survival pricing.

This article isn't about whether Chinese EVs are better. It’s about why they are flooding global markets, why Europe and the US are reacting with tariffs, and why none of this makes sense unless you understand one word:

Deflation.

I. The Deflation Problem Nobody Wants to Confront

Deflation is not "cheap prices."

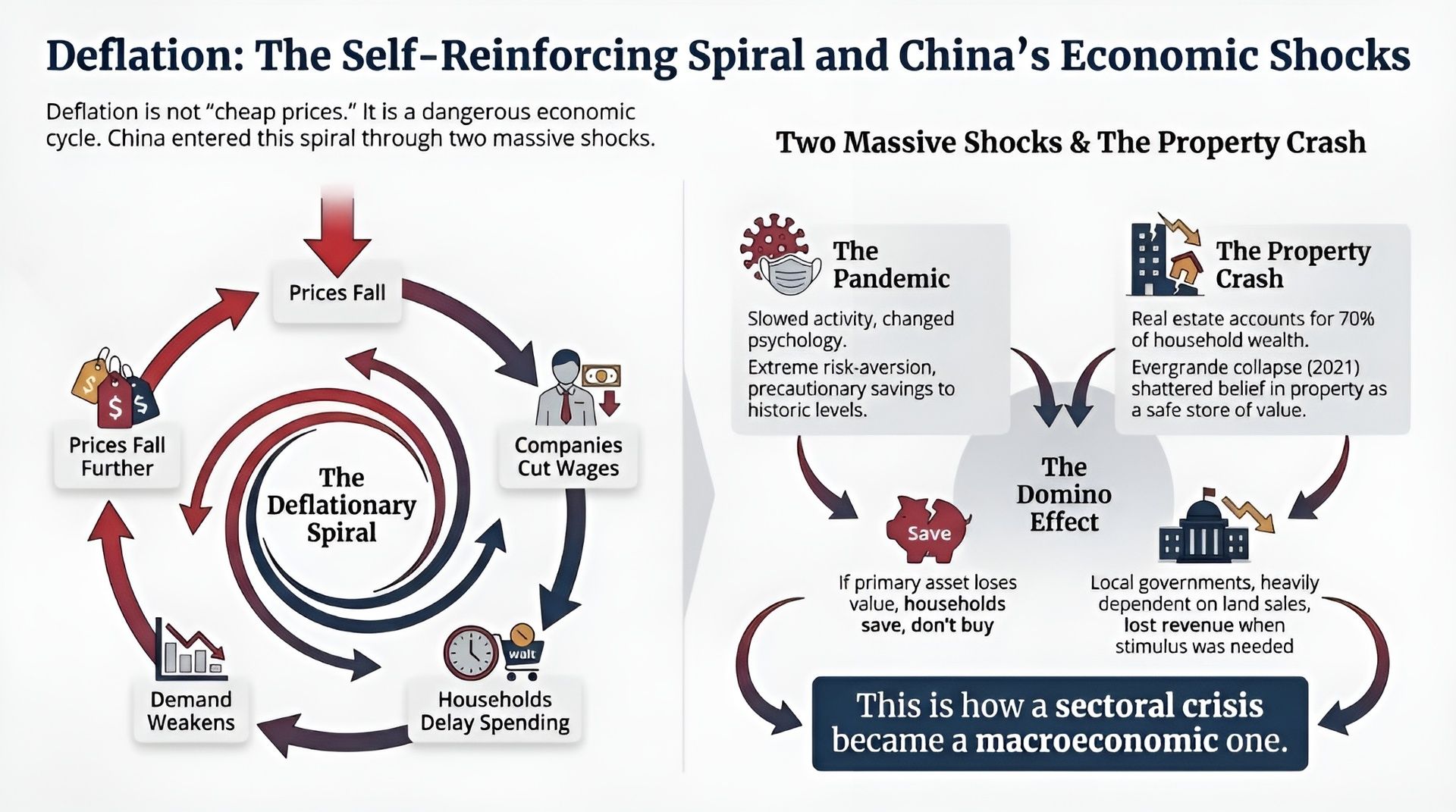

It is a self-reinforcing spiral:

prices fall → companies cut wages → households delay spending → demand weakens → prices fall further.

China entered this spiral through two massive shocks.

The Pandemic and the Property Crash

The pandemic didn't just slow activity, it changed psychology. Households became extreme risk-averse, pushing precautionary savings to historic levels.

Then came Evergrande. Real estate accounts for 70% of household wealth in China. When Evergrande collapsed in 2021, it shattered the belief that property was a safe store of value.

Chinese property giant Evergrande delisted after spectacular fall - BBC Article

According to an IMF study of 470 real estate entities, by 2023, 72% of property developers (by assets) faced defaults. Their liabilities reached 80% of assets, and strikingly, 26% of those liabilities were pre-sold homes they couldn't deliver.

Bloomberg data shows property prices in major cities fell ~27% by 2025, creating a devastating feedback loop. Buyers lost confidence, sales dried up, developers defaulted on more projects.

If your primary asset is losing value and developers can't deliver homes you've already paid for, you don't buy a new car. You save.

Local governments, heavily dependent on land sales, lost revenue precisely when stimulus was needed. This is how a sectoral crisis became a macroeconomic one.

Deflation Cycle Explained - How it All Started in China

The Indicators Show This Isn't Temporary

Three signals confirm how deep this runs:

Producer Prices (PPI): Factory-gate prices fell 2.1% YoY in October 2025, marking 37 consecutive months of decline, clear evidence of sustained industrial deflation.

Consumer Prices (CPI): Latest data for November 2025 shows headline inflation hovering at just 0.7% (with Core CPI at 1.2%), confirming demand is too weak to rebuild pricing power.

GDP Deflator: This broad measure declined to 105.2 from 106.0, creating a rare inversion where nominal GDP grows slower than real GDP—a classic deflationary warning sign.

II. "Involution": When Competition Turns Destructive

By 2025, Chinese officials and citizens settled on one word to describe the economy: Involution (内卷). It describes a system where everyone works harder for diminishing returns.

A Bloomberg analysis tracked 67 everyday items: prices fell for 51 of them between 2023 and 2025.

Home prices: -27%

Eggs: -14%

Beef Shanks: -14%

Urban rents: -9%

Milk: -4%

Wages followed. Entry-level salaries in EVs and renewables fell ~10% from 2022 peaks by 2024. Average pay offers across major cities dropped ~5%.

The share of "zombie firms", companies whose profits (EBIT) cannot cover debt interest payments, rose from 19% to 34% between 2020 and 2024 (it averaged 18% from 2014-2019). These walking-dead firms undercut healthy competitors, dragging everyone down.

Add aging demographics and shrinking wages, a turnaround becomes incredibly difficult.

Involution Explained: How It Has Been Effecting The Economic Growth in China

III. Automotive: A Perfect Sample of Deflation

A Bloomberg analysis of China's top 70 automakers manufacturing above 10,000 cars/year, reveals brutal reality: only ~15% operate above 70% factory utilization, the minimum for profitability.

The Leaders: Tesla leads with ~96%, followed by Xiaomi and Chery. BYD runs at >80%.

The Laggards: Foreign joint ventures like SAIC-VW, SAIC-GM, and GAC-Honda plummeted below 50%.

The price war tells the story:

2022: 95 models cut prices

2023: 148 models

2024: 227 models

Margins collapsed from 7-8% (2017-18) to ~4.4% (2024-25). For context, healthy global OEMs, mass producers, operate at 6-10%. Chinese manufacturers are running on half the profitability of their Western or Japanese peers.

Bloomberg's analysis (2023-2025) shows the pain is not evenly distributed:

Toyota, Honda: -5% to -10%

Mercedes-Benz: -20%

BMW, Li Auto: -25% to -30%

Even Winners Are Bleeding

BYD dominates with 27% EV market share, 4 million vehicles, and deep vertical integration. And yet, even BYD had to slash prices by ~32%.

If the strongest player must do this to survive, weaker ones have no margin for error.

IV. Export or Extinction

When domestic demand cannot absorb capacity, exports become the only pressure valve. China became the world's largest auto exporter to escape the domestic pressure cooker.

Top 10 Destinations for Chinese Car Exports (Jan – May 2025):

UAE: $2.7B (+551% vs 2022)

Belgium: $2.6B

Mexico: $2.4B

UK: $2.3B

Russia: $2.2B

Brazil: $2.1B (+970% vs 2022)

Australia: $1.8B

Saudi Arabia: $1.3B

Spain: $1.1B (+1,410% vs 2022)

Kazakhstan: $0.9B (+2,041% vs 2022)

(Note: South Korea also saw a massive surge to $0.8B, up 567% from 2022, highlighting the shift toward nearby Asian markets.)

This data reveals exactly where China is building its buffer markets and This hits home personally. I lived in Saudi Arabia for 13 years until 2002. Chinese cars were nonexistent. Seeing the Middle East, particularly the UAE, become their top market is a shift I never imagined.

AlixPartners projects Chinese automakers will capture 30% of global sales by 2030. This isn't just growth; it's a structural takeover.

Why Tariffs Don't Stop the Flow

Even with ~35% EU tariffs, Chinese EVs remain competitively priced. Mexico is hiking tariffs from 20% to 50% in January 2026 under US pressure.

Why doesn't this stop the flood? Because selling at catastrophic losses into domestic deflation is worse. They pay the duty, undercut local rivals, and still offer superior value.

When the EU targeted EVs, China shifted to plug-in hybrids not covered by duties. When direct channels close, they pivot to the Middle East, Brazil, Eastern Europe, and Indonesia.

V. Innovation Is Real and That’s What Makes This Dangerous

Is China faking it? Imitating? Ahead only because of subsidies? Absolutely not.

I've managed projects for GM, Toyota, Honda, Opel, and McLaren. The typical Western cycle from RFQ to mass production takes 4-5 years. China does it in 2 years.

At IAA, Dr. Angela Wang from Neusoft presented data showing China’s automotive R&D growing at ~21.2% CAGR (2019–2024) versus ~3.7% in Europe and the US.

The data behind China's innovation lead, presented at IAA 2025 by Neusoft

John Moavenzadeh from MIT's Mobility Initiative debunked the "China imitates" myth, the Shenzhen-Hong Kong-Guangzhou corridor is now the world's top innovation cluster.

Myths Shattered Related to China’s Automotive Success - MIT Mobility at IAA 2025

The secret isn't just money, it's mindset and regulation. A Tier-1 supplier engineer at IAA told me: "European regulations kill innovation. You can't launch until you're 100% certain of a zero-error product. That costs money and years to market."

China flips this. Instead of disruptive improvements, they follow incremental improvements. Fewer regulations and accepting consumers treat cars like software: launch v1.0, gather real-world data, update to v2.0. I have made a detailed video explaining this dynamic.

A German engineer gave me an example of Xiaomi, as the car and home appliances is based on the same software platform: "You tell the car: 'Set navigation home, start the washing machine, turn AC to 24°C.' And it just works."

But this speed compresses quality cycles. Cars, platforms, technology that once matured over 6-8 years now cycle every 2 years. By the time long-term faults emerge, engineering teams have moved on. The technology is real. The sustainability of this pace remains an open question.

They are desperate, cheap, and technologically miles ahead. That is a dangerous combination.

VI. Tech Nationalism Strikes Back

As exports surge, resistance has evolved from simple trade disputes to Tech Nationalism. US tariffs hit 100%, EU hit 35%, and Mexico is rising to 50% in 2026. Tariffs were the first wall. Now we’re seeing targeted chokepoints.

The Nexperia Seizure: The Dutch government used a Cold War-era statute to seize control of Nexperia (owned by China's Wingtech). Nexperia holds 40% market share in basic transistors and diodes, components essential to global auto production. China blocked shipments in retaliation. Since 80% of Nexperia's production came from China, this nearly brought the global auto industry to a standstill. I have written extensively on it.

Gotion: VW's battery partner planned a Michigan plant. After repeated political opposition, the project is dead.

Chip Blockade: President Trump expanded restrictions, blocking NVIDIA H200 sales to China, cutting off the AI hardware needed to progress, however these restrictions have been loosened this week.

Deutsche Bahn: Faced intense backlash this week, after news leaked that from their 1 billion € rehaul of fleet i.e. new electric and hybrid buses, a considerable amount will be ordered at BYD and Zhongtong. The reality revealed today: MAN (German) won 3,000 buses, BYD (Chinese) won only 300. Two years ago, this would have been simple procurement. Today, it's politically untenable.

Temu & Shein: Chinese consumer giants face growing scrutiny across Europe, with Temu's Dublin offices recently raided.

The uncomfortable truth: mutual dependence under stress.

China cannot fully decouple, it needs export markets to relieve domestic deflation. The West cannot fully block, it needs affordable EVs, batteries, rare earths, and supply chains to its keep its industries running.

What Breaks First?

China's EV export flood is not a sign of dominance. It is a symptom of structural fragility.

Beijing recently launched an "Anti-Involution" campaign to force consolidation, but the road ahead is brutal. We're heading for a massive shakeout.

Either domestic demand is restored through genuine consumer confidence, or the automotive industry faces consolidation eliminating dozens of manufacturers and millions of jobs.

The Chinese EVs arriving at impossibly low prices aren't a sign of strength. They're a symptom of an economy under extraordinary strain, exporting its overcapacity crisis to the world.

The question isn't if this breaks. It's what breaks first, and who pays when it does.

My Take:

This isn't about unfair competition. It's about an economy trapped in a deflationary spiral finding the only pressure valve available: exports.

Questions for you:

Do you think China can stimulate domestic demand enough to avoid consolidation? Or are we headed for a major shakeout in the next 12-24 months?

What's your prediction for how many of those 70 automakers survive to 2027?

Reply with your thoughts, I'm genuinely curious what you're seeing from your angle.

Want Ground Reality, Not PowerPoint Slides?

I bring 9 years of on-the-ground automotive experience, spanning OEMs, Tier-1 suppliers, and real-world e-mobility usage, including hundreds of personally logged charging sessions.

I offer project-based advisory that combines macro signals with execution reality and customer behavior.

Available for: Strategic deep dives, tailored projects, or 1-on-1 advisory sessions.

Also kindly share if you liked this Newsletter and give feedback, either here in comments or via dm on Linkedin. This will help me to improve.

Did This Newsletter Edition Provide Valuable Insights?

Thanks and till next week,

Haseeb

Sources:

Bloomberg Article 1 / Bloomberg Article 2 / Bloomberg Article 3

IMF Report

Alix Partners Market Share Forecast

CNEV Post: Price Cuts

DB Nomination / Protest Against DB

Evergrande BBC / NYT

PPI / CPI / GDP Deflator

Temu office raided - Guardia / Shein Investigation by EU

EU Tariffs on China - Reuters

Mexico Tariffs on China