Key Points

The Trap: West is treating China's automotive rise like football fandom, cheering for teams instead of analyzing systems

The Culture: "Perfectionist Society" (Europe) vs. "Iterative Society" (China).

The Engine: How teenagers and "beta testers" fuel China's speed.

The Innovation Loop: Chinese OEMs launch imperfect products → consumers accept and provide real-world data → rapid iteration → trust builds → loop accelerates

The Data: 61% of Chinese consumers trust robotaxis vs. 24% of Germans.

For the last few years, I've been closely following China's automotive industry and its rapid expansion across Europe. I’ve spent countless hours comparing the data points, prices, performance, charging curves, ADAS features.

The transformation has been staggering. From being non-existent on the global stage just a decade ago, Chinese OEMs are now everywhere. Surprise fact, their largest export market is UAE. I have written a detailed article how the local deflation turned China into export powerhouse.

When I graduated in automotive engineering in 2011, the dream was always to work for a German, Japanese, or US OEM. That was the ceiling. Today? My university peers are leading projects for Chinese brands in the UAE and Pakistan.

That reality was unimaginable a decade ago.

Now, the momentum feels relentless. Google "Chinese Cars" and you are bombarded: car carriers arriving in European ports, Robotaxis scaling in cities, and battery announcements from CATL and BYD getting more traction than traditional car launches.

It's relentless. It's impressive. And it's easy to fall into a trap.

The Trap: When Analysis Becomes Tribalism

Following this story through social media, I kept seeing a common narrative: The West has fallen behind. China is crushing it. A few Western OEMs will be extinct within years.

Depending on where people stand emotionally on powertrains, I've seen reactions swing to extremes. Some hope for the demise of Western brands, while others defend them blindly. No meaningful debate takes place, people argue for the sake of arguing.

As an engineer who built a career in Germany, I find this deeply uncomfortable. It feels less like serious industrial debate and more like football fandom.

We've devolved into knee-jerk reactions. It feels like fans hoping their own team loses just so the manager gets fired, or cheering when an “own” player gets injured so their favorite substitute can play. Yes, this level of toxicity exists.

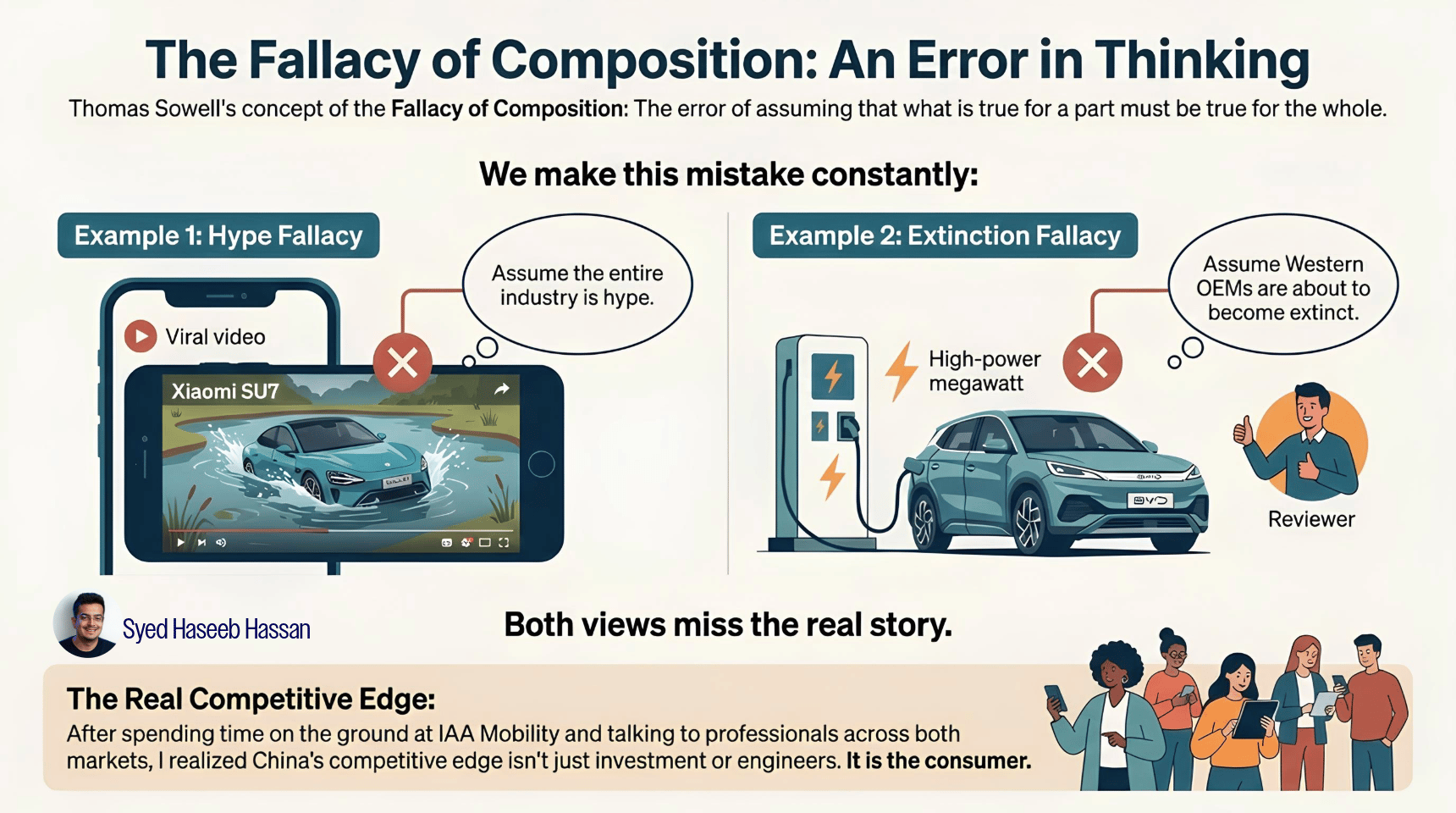

I couldn't explain this dynamic properly until I came across Thomas Sowell's concept of the Fallacy of Composition: the error of assuming that what is true for a part must be true for the whole.

We make this mistake constantly:

We see a viral video of a Xiaomi SU7 driving into a pond, and we assume the entire industry is hype.

We see a few amazing car reviews or BYD megawatt charging, and we assume the Western OEMs are about to become extinct.

Fallacy of Composition: The Trap We Fall In Observing Chinese Auto Industry

Both views miss the real story. After spending time on the ground at IAA Mobility and talking to professionals across both markets, I realized we are asking the wrong questions. We are looking for an industrial answer (factories, subsidies), but the reality is cultural.

The Real Competitive Edge: The "Beta Tester" Mindset

I've written before that China's competitive edge isn't just investment or engineers. It is the consumer, to be specific consumer mindset.

Portrait of Chinese Consumer: Presented By Dr. Angela Wang (Neusoft) at IAA 2025

In Europe, and Germany specifically, the engineering culture is built on a single, non-negotiable pillar: Perfection. We do not launch a product until it is finished. A car is a mechanical promise of reliability.

China operates on a completely different frequency. They've embraced the "Beta Tester Mindset."

Chinese consumers are fundamentally different:

Tolerant of novelty and early mistakes

Passionate about change

Demand cutting-edge technology and willing to pay for "beta" features

See cars as lifestyle spaces, not just transport

Far more open to autonomous driving

According to BCG survey, numbers tell the story: 61% of Chinese consumers would ride in a robotaxi today, versus only 24% in Germany.

Chinese Consumers Are Much More Open To Ride in Robotaxi Compared to EU: BCG at IAA 25

This isn't just a preference difference. It's a structural advantage that creates a powerful feedback loop.

Why This Trust Exists

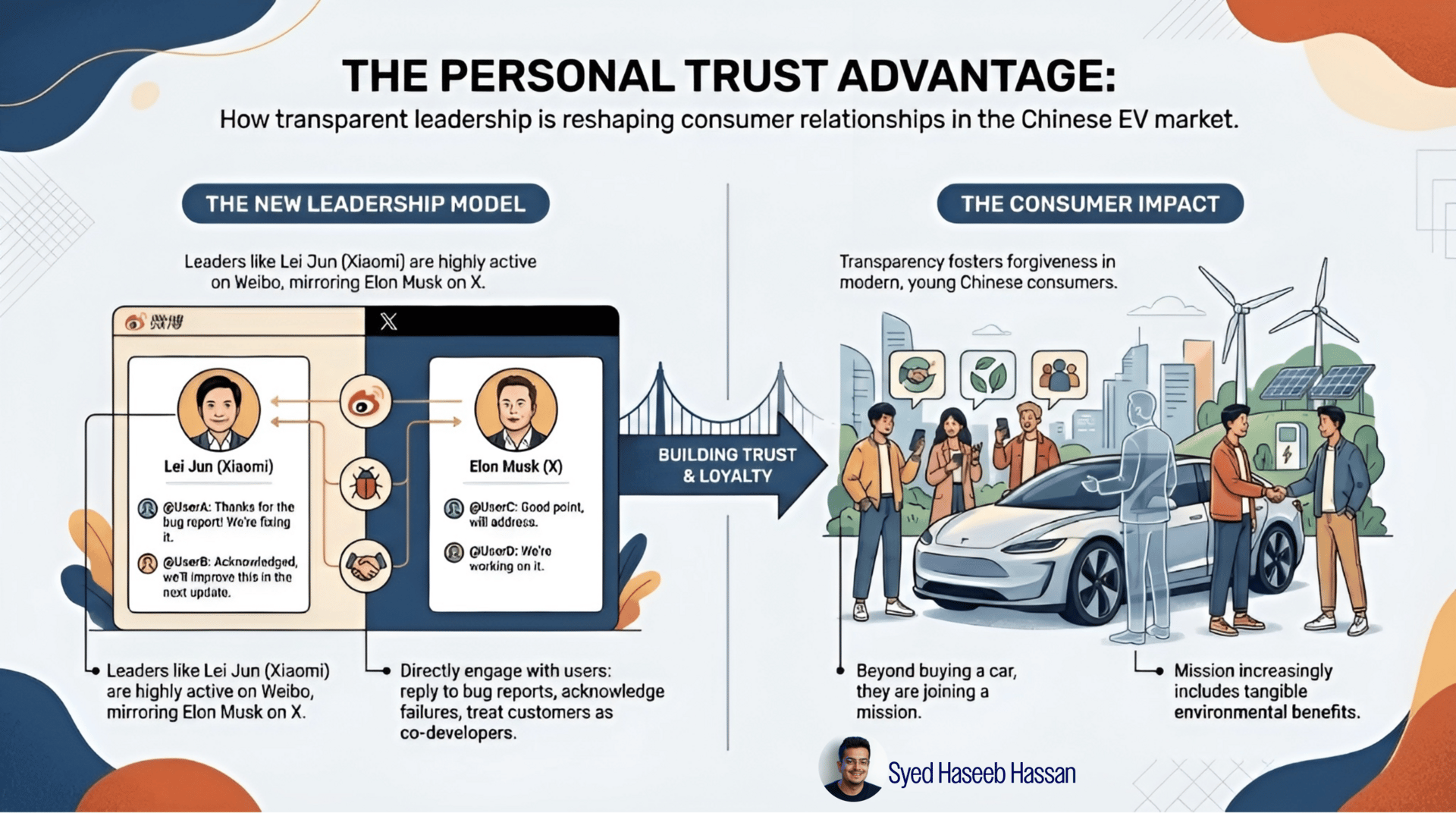

This trust isn't blind; it's personal.

Leaders like Lei Jun (Xiaomi) are hyper-active on Social Media e.g. Weibo and Douyin (~67 million followers), similar to Elon Musk on X. They reply to bug reports, acknowledge failures, and treat customers like co-developers.

This transparency makes modern, young Chinese consumers more forgiving. They're not just buying a car; they're joining a mission. And increasingly, that mission includes tangible environmental benefits.

Use of Social Media to Connect with Young Chinese Consumers: Lei Jun (Xiaomi)

How This Cultural Shift Started

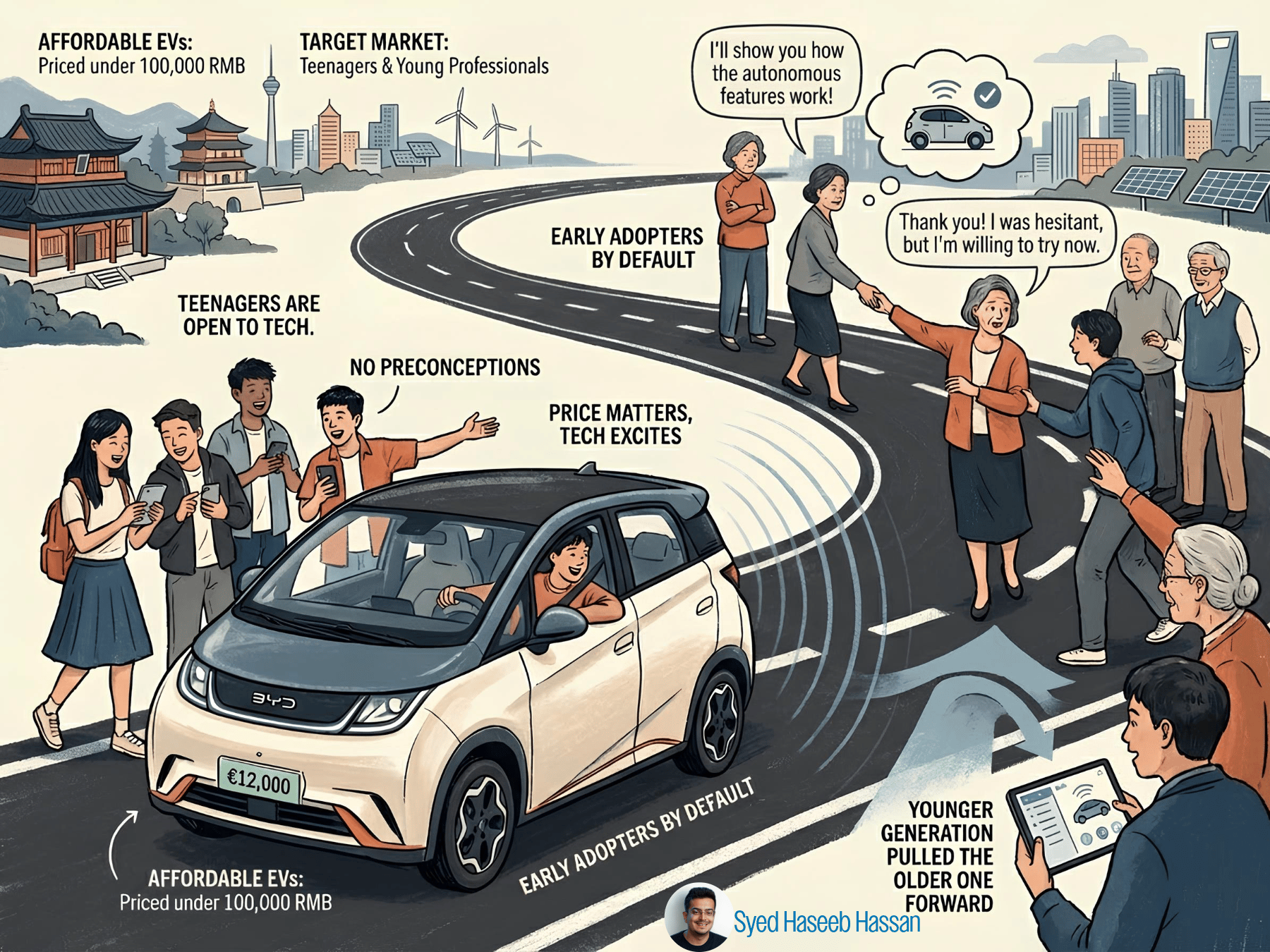

I spoke with a Chinese supplier representative at IAA about how this openness began, and the story stuck with me.

During the last decade, it started with affordable EVs from BYD and others, priced under 100,000 RMB (~€12,000). The target market? Teenagers and young professionals about to get their driving license.

Think about that strategy:

Teenagers are naturally open to technology.

They have no preconceptions about "how cars should work."

They're getting their first car: price matters, tech excites them.

They become early adopters by default.

OEMs trialed features like autonomous driving for free, building habits and trust. One middle-aged woman I spoke with admitted: "I hesitated at first. But since it was already in the car, and others used it, I tried it... and now I trust it."

Over time, the younger generation pulled the older one forward, creating a culture that embraces change instead of resisting it.

Young Chinese Consumers Made The Older Generation Trust ADAS in Cars

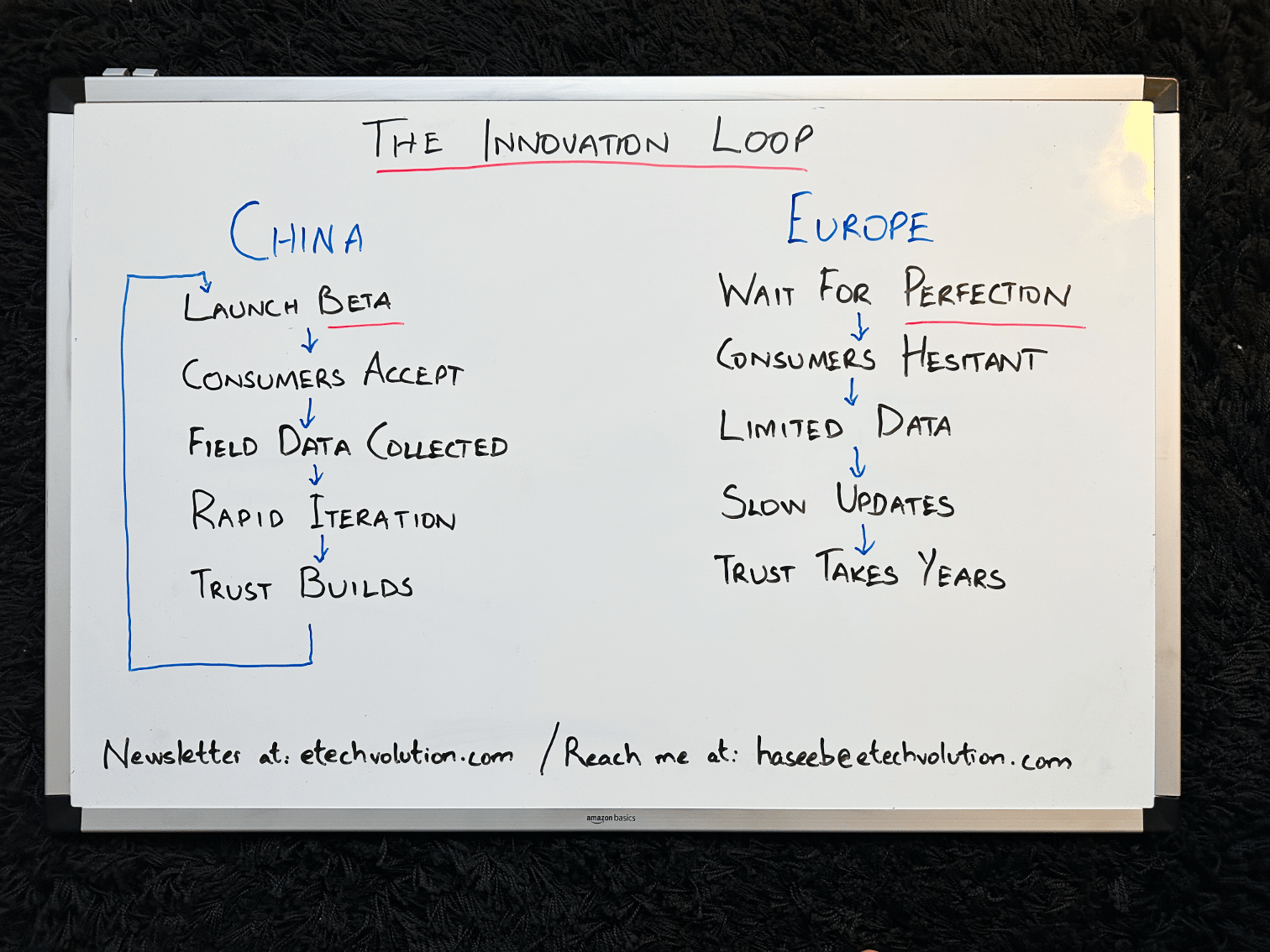

The Innovation Loop in Action

This creates what I call the "Innovation Loop":

Companies launch bold products faster.

Consumers adopt and provide real-world data.

Companies iterate immediately based on actual usage.

Consumers see rapid improvement and trust builds further.

Europe's approach is different:

Wait for 100% proven technology.

Launch with luxury models first (S-Class, 7 Series), to recover R&D costs.

Wait years for technology cost reduction to mass market.

Result: Miss the opportunity for mass-scale data collection

Innovation Loop: China vs Europe for Automotive Industry

5 years ago, while I was working with OEMs at Tier 1 automotive supplier, the typical development cycle was around 5 years. China has drastically reduced it to just about 24 months.

Part of this is engineering talent and vertical integration. But a huge part is that they can launch "version 1.0" knowing consumers will accept it, provide feedback, and adopt "version 2.0" few months later.

How China Reduced Development Timeline to 2 years: Dr. Angela Wang (Neusoft) at IAA 2025

The Trade-Off We Don't Discuss

Here's the uncomfortable truth: If a European OEM released a vehicle that drove into a pond, the brand would be crucified.

West demand perfection. That's a choice western society has made, and it comes with costs:

Slower development cycles

Higher upfront R&D costs

Less real-world data to improve systems

Technology that arrives mature but late

I'm not arguing we should lower safety standards. But how many people advocating for this speed would actually accept the role of a beta tester, knowing the car could fail at a critical moment?

If you're not ready to accept that risk, then we need to honestly acknowledge what we're trading off and what we're competing against.

The Chinese approach compresses quality validation cycles. Technology that once matured over 5 years now cycles every 2 years. By the time long-term reliability patterns emerge, the next generation is already shipping.

The technology is real and advancing fast. The sustainability of this pace remains an open question, as it will be interesting if reliability and quality are kept to the maximum across a decade.

But right now, speed is winning.

But Consumer Mindset Doesn't Explain Everything

European OEMs are lagging in multiple areas. China is miles ahead. Tesla shaped the software-defined vehicle era. European and Legacy OEMs needed a wake-up call, and they've gotten it.

But understanding the consumer mindset gap only explains how China moves fast with product iteration. In the next few weeks, I’m going to explore the other two uncomfortable pillars of this speed:

Work with Me!

I bring 9 years of on-the-ground automotive experience, spanning OEMs, Tier-1 suppliers, and real-world e-mobility usage, including hundreds of personally logged charging sessions.

I offer project-based advisory that combines macro signals with execution reality and customer behavior.

Available for: Strategic deep dives, tailored projects, or 1-on-1 advisory sessions.

Also kindly share if you liked this Newsletter and give feedback, either here in comments or via DM on Linkedin. This will help me to improve.

Thanks and wishing you happy vacations and a great new year. After 1 week break, I will be back in January.

Haseeb