Key Takeaways

29 white label Supercharger sites (166 chargers) are now operating across the UK, representing about 7.5% of Tesla's Superchargers and 14% of its total sites nationwide.

Tesla supplies the hardware, backend, operations and maintenance, while partners bring the sites, capital, installation, and operate under their own branding.

The approach allows Tesla to scale in parallel with its own network expansion, requiring minimal additional effort or capital investment.

Payment flexibility unlocks new markets: RFID, contactless, and credit card acceptance capture non-Tesla drivers and commercial fleets beyond Tesla's app-based customer base.

Early deployments face technical and pricing constraints: V3.5 hardware (500V-limited) restricts 800V vehicle charging to 100-150kW, while premium pricing (double to triple Tesla owned Supercharger rates) creates tension between partner profitability and Tesla driver acceptance.

Tesla’s white-label strategy marks a turning point in the EV charging landscape, shifting from building infrastructure to monetizing its technology and expertise as a service.

Table of Contents

A Shift in Tesla's Charging Strategy

For more than a decade Tesla built, owned, and operated every Supercharger site itself. That approach guaranteed reliability and control while supporting rapid expansion.

In previous articles, I showed how Tesla's 74,000 chargers across 54 countries delivered 4.8 TWh in just three quarters of 2025, more than ABB and Alpitronic's lifetime totals combined.

Now the company is evolving: instead of owning every site, it sells its technology as a product.

Tesla first explored selling chargers to large operators a few years ago. At Power2Drive 2025 in Munich, Tesla formalized the shift. The company began offering its Supercharger technology as a product that other businesses can purchase and operate under their own brand. Tesla continues to run the software, billing, and maintenance behind the scenes.

Tesla White-Label Superchargers and How it Built for Business Owners

How the White Label Model Works

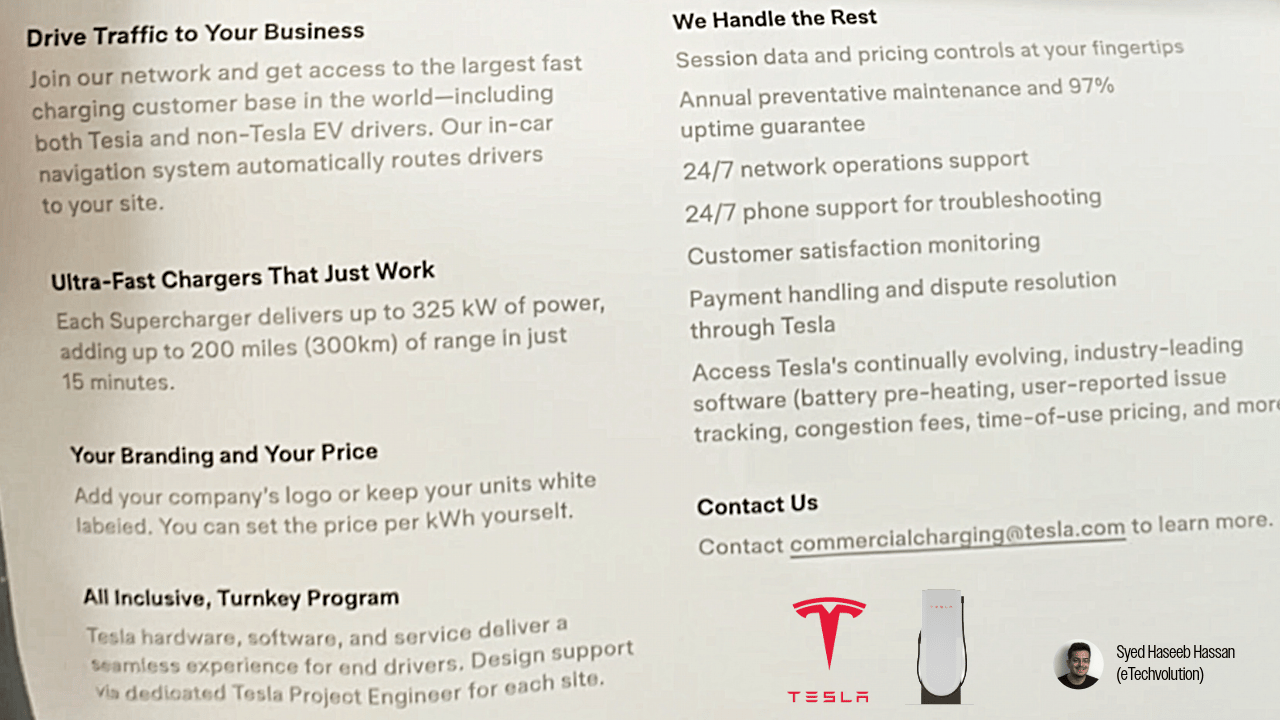

Tesla sells its Supercharger hardware and software as a turnkey package.

Tesla provides:

Supercharger cabinets and stalls (V3.5 generation: 250/325 kW)

Monitoring, maintenance, and firmware updates

Hotline and technical support

Billing and full integration with the Tesla Map and App

Partner provides:

Site, civil works, and grid connection

Capital investment

Pricing strategy for charging

Each site requires at least four charging posts and one power cabinet. Tesla earns an upfront margin on the hardware and a recurring service fee, likely linked to energy delivered.

Tesla White-Label Supercharger Overview: Minimum Requirement for Hardware

Tesla Supercharger for Business Flyer - Power2Drive 2025

Driver Experience and Integration

From the driver's perspective, white label sites behave like any other Supercharger. The car routes there automatically, the plug and charge system handles payment, and the session appears in the Tesla account.

To understand why this matters strategically, let’s look at how the UK rollout is structured and what it reveals about the model’s economics.

Tesla Supercharger for Business: How it is designed for users

Understanding EG Group, EV Point, and EV On The Move

Tesla’s first European white-label agreement came in Nov 2023 with EG Group under its EV Point brand, the first deal of its kind in Europe.

Around the same time, EG Group co-founder Zuber Issa established a separate company, EG On The Move, which later acquired dozens of UK forecourts from EG Group in 2024.

Today, the structure looks like this:

EV On The Move (EG On The Move): It operates 28 Tesla Supercharger sites with approximately 158 Superchargers, plus 50–60 chargers from other suppliers (around 270 total charge points).

EV Point (EG Group): It operates 1 Tesla Supercharger site (Uttoxeter, 8 Superchargers), plus roughly 63 chargers from Alpitronic, ABB, and Tritium.

EV On The Move has effectively become Tesla’s largest white label customer in Europe, while EV Point has shifted toward other charging hardware suppliers.

EV On The Move Supercharger Sites

The UK Deployment So Far

Analysis of field data (October 2025) shows:

2241 Superchargers are available across 206 Sites

29 sites and 166 charging posts in total are white-label superchargers

Operators: EV On The Move (28 sites) and EV Point (1 site)

White-label chargers now account for about 7.5 percent of all Tesla stalls in the UK, or 14% by site count. This deployment accelerated rapidly through 2024-2025, with the majority of sites coming online in the past 18 months as Tesla formalized its white label program.

White-Label Supercharger Sites in UK

Overview of Opening of Tesla & White-Label Superchargers in UK (2015 - 2025)

Deployment Pattern

Analysis of the 28 EV On The Move sites reveals three distinct geographic patterns:

Direct competition (10 sites within 10 miles of Tesla): These locations sit at existing forecourts and service areas positioned 3-10 miles from Tesla Superchargers.

Regional coverage (11 sites at 10-30 miles from Tesla): Standalone locations in secondary corridors where the nearest Tesla Supercharger is 10-30 miles away.

Geographic cluster (5 sites in Liverpool/Knowsley area): Five sites form a local charging network 2-5 miles apart, but 11-22 miles from the nearest Tesla Supercharger at Warrington Burtonwood.

Whether these patterns reflect deliberate strategic planning is unclear from available data. However, the patterns do create distinct competitive dynamics: proximity sites compete directly with Tesla on convenience, regional sites face less immediate competition, and the Liverpool/Knowsley cluster establishes a local network in an area Tesla hasn't served.

Payment Methods and Flexibility

EV On The Move has implemented multiple payment methods beyond Tesla's standard plug-and-charge system, making white label sites accessible to a broader customer base.

Accepted payment methods:

Tesla plug-and-charge (automatic billing for Tesla drivers)

Tesla App (for all EV users)

Contactless payment, RFID

Credit/debit cards

Apple Pay and Google Pay

This flexibility removes a significant barrier for non-Tesla EV drivers. Tesla-owned Superchargers require either a Tesla vehicle (plug-and-charge) or downloading the Tesla App for non-Tesla vehicles. EV On The Move's approach makes charging accessible to occasional users, drivers unfamiliar with the Tesla ecosystem, and crucially, fleet operators using corporate fleet cards.

Accepted Payment Method for Tesla White-Label Chargers: EV On The Move

Pricing and Utilization Dynamics

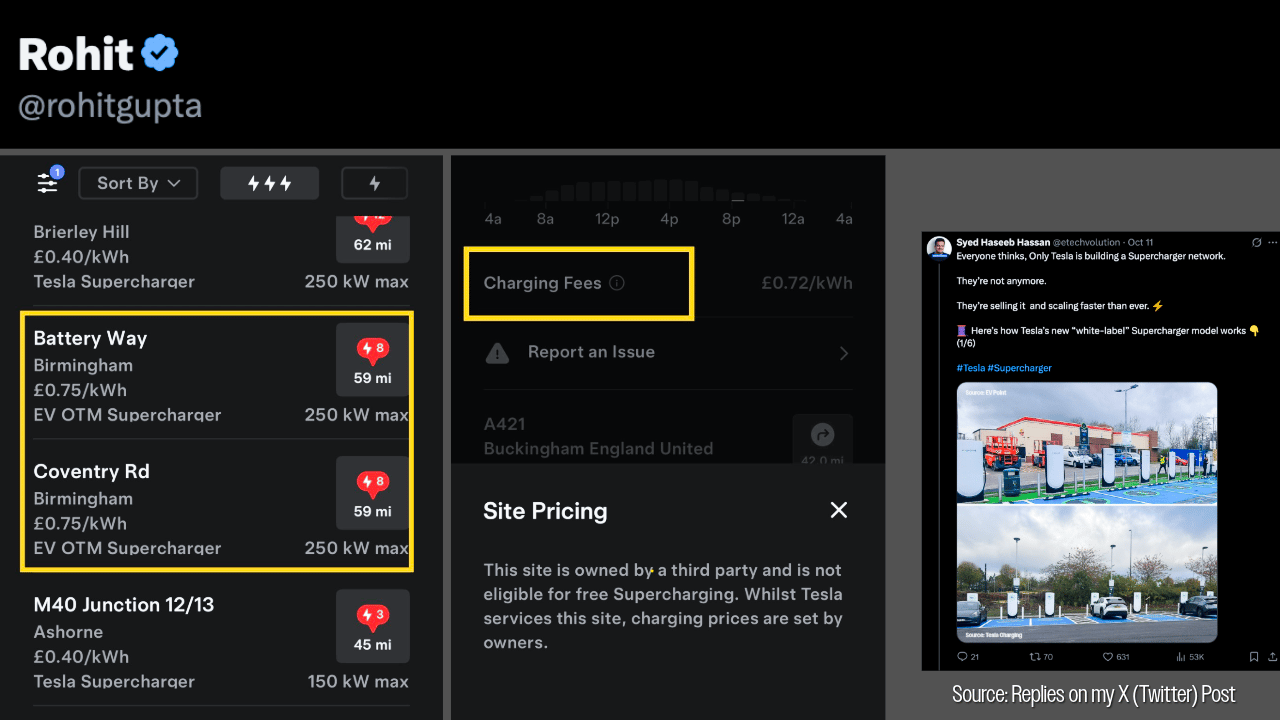

The pricing gap between partner-operated and Tesla-owned sites is significant and reflects different business models.

Tesla-owned Superchargers:

Time of use pricing with 2-3 tiers (peak and off peak hours)

Tesla / Member prices: £0.24 - £0.40/kWh (off peak hours)

Non-Tesla prices: £0.37 - £0.55/kWh (peak hours)

EV On The Move and EV Point:

Flat £0.72 - £0.75/kWh at 24 sites (85% of supercharger network)

£0.55/kWh at two newer sites (Promotional offer)

Few months ago the prices at EV OTM superchargers were £0.65/kWh (zapmap’s reviews)

No time of use variation or membership tiers

Same pricing for Tesla and non-Tesla vehicles

While Tesla likely offers partners time of use pricing options, EV On The Move has opted for fixed rates more aligned with the UK's broader fast charging market, where rates typically range between £0.75 - £0.90/kWh.

Charging Prices from Tesla navigation: Tesla own Superchargers vs EV OTM (13.10.2025)

Impact while charging a car:

Let’s take Tesla Model Y LR with 75 kWh usable battery and assume a person charge 10-80% or 52.5 kWh.

Here are the prices overview

Tesla Supercharger - Off Peak hours: £12.6 - £19.4

Tesla Supercharger - Peak hours: £21 - £28.8

White-Label Supercharger - Best Prices: £28.8

White-Label Supercharger - Maximum Prices: £39.3

That's nearly double or triple the price depending on time of day.

Charging Price Comparison: Tesla Model Y (10-80%) Based on All Available Prices

The Pricing Discovery Problem

Tesla’s navigation currently lists these partner sites as normal superchargers without showing rates, leading to “price shock” for first time visitors. Tesla’s loyalty perks and free charging credits also don’t apply at partner-operated sites.

As awareness spreads in driver communities, some Tesla drivers now check location names before routing, adding an extra step to what Tesla designed as a seamless experience.

Tesla App Overview: How EV On The Move Superchargers Appear

Partners recover capital costs per site through charging revenue alone, without vehicle sales to cross subsidize operations. Fixed pricing across all hours and customer types simplifies operations but means every session must contribute to cost recovery.

Tesla charges partners per kWh fees for backend services, billing infrastructure, and maintenance support. These costs must be passed to customers on top of hardware amortization and energy expenses, meaning white label pricing will structurally exceed Tesla owned site rates.

Grid contracts create another cost disadvantage. Tesla's massive energy demand across thousands of global Superchargers provides negotiating leverage for really attractive electricity rates that individual partners, perhaps cannot match.

Partners may also lack the data infrastructure or operational experience to implement demand responsive dynamic pricing, despite Tesla likely making this capability available. Combined with these structural cost pressures, premium pricing becomes necessary rather than optional.

Convenience wins when:

Drivers are already stopped at a forecourt or service area

The nearest Tesla alternative requires 20+ minutes of detour time

Battery levels are low

Navigation routes them automatically without surfacing price differences upfront

Non-Tesla drivers using charging apps see competitive rates versus other UK networks

Fleet drivers using company fleet cards prioritize convenience over cost

Price sensitivity drives avoidance when:

Tesla alternatives are within 10-15 minutes

Drivers have sufficient range to reach cheaper options

Regular users become aware of pricing differences and adjust routing behavior

Free charging promotions apply only at Tesla-owned sites

Strategic Value for Tesla

The white label model directly addresses Tesla's three biggest constraints: capital, land, and speed.

Strategic Value and Benefits For Tesla with White-Label Superchargers

Accelerating Non-Tesla Adoption

Payment flexibility at white label sites serves Tesla's broader strategy of becoming the universal charging standard. By accepting fleet cards, credit cards, and contactless payments, white label partners make Superchargers accessible to drivers who won't download the Tesla App.

Tesla collects service fees from every charging session regardless of payment method. As non-Tesla EV adoption accelerates, capturing this volume through both Tesla owned and partner operated sites positions Tesla as the dominant charging infrastructure provider globally for years to come.

Tesla continues building flagship sites in major corridors, typically 12+ stalls at high-traffic locations, while partners deploy smaller 4-8 stall sites at secondary routes or their heavily visited locations.

Technical Limitations

White label partners currently receive V3.5 Superchargers. The V4 posts can deliver up to 1000V but are limited because the V3 power cabinet supports only up to 500V. This works well for most current EVs, which are built on 400V architecture. However, as the industry shifts toward 800V technology in coming years, this limitation could become significant.

While 800V EVs can charge at 250kW+ (and some models like Lotus Emeya, Smart #5, and XPENG G9 exceed 400kW on compatible hardware), V3.5 Superchargers limit these vehicles to 100-150kW.

The Mercedes CLA EQ, launched this year, cannot use V3.5 Superchargers at all. Mercedes omitted the DCDC converter and chose not to include relays for switching battery packs between series and parallel configurations, making the vehicle incompatible with DC Chargers with a lower output Voltage than 800V.. So far, this is the only vehicle I know of that cannot use V3.5 Superchargers, and they reversed the decision, as they will introduce DCDC converter in 2026, but there is a hint of risk.

For such cases, V4 Superchargers are a necessity.

Competitors including Alpitronic, ABB, Kempower and Ekoenergetyka already supply chargers that fully support up to 1000V. Unless Tesla extends V4 hardware to partners soon, white label sites risk falling behind within the next three to five years.

Comparison of V3.5 and V4 Tesla Superchargers

Market Implications

Infrastructure Investors

Gap-filling sites are more defensible. Clustered deployments in underserved regions create network effects; sites within minutes of existing Tesla locations face utilization challenges.

Pricing creates dual dynamics. Premium rates may alienate Tesla drivers but sit competitively within local fast charging markets for non-Tesla users.

Customer mix determines resilience. Sites capturing Tesla drivers, non-Tesla EV users, and fleet customers would show stronger utilization than Tesla-only traffic.

Prioritize V4 hardware roadmap. If investing by 2026, negotiate for 1000V V4 Superchargers. Accepting V3.5 in 2027+, especially in countries, where 800V vehicles are increasingly registered, creates a huge risk.

Payment flexibility broadens the market. Fleet card and contactless acceptance unlock customer segments beyond Tesla's base.

Competing CPOs

Entry barriers are lowering. Tesla's turnkey package (quality hardware, billing integration, navigation routing, maintenance support) enables new competitors rapidly.

Maintenance becomes a differentiator. Tesla handles remote monitoring and repairs, though fault detection workflows need clarification (proactive alerts vs partner-reported issues).

Other Suppliers offer technical advantage. White label partners currently receive V3.5 (500V limited); Alpitronic, ABB, Kempower, Ekoenergetyka provide 1000V capability today.

Price positioning is critical. Position between Tesla-owned rates and white label premium pricing to capture price conscious drivers. Without competitive pricing, traffic shifts toward white-label sites.

Potential Partners

Site selection is decisive. Gap-filling and mini-networks outperform proximity to existing Tesla sites. Favor locations Tesla is unlikely to serve directly.

Diversify payment methods immediately. Fleet cards, contactless, and credit card acceptance unlock customer segments beyond app-based charging.

Amenities create competitive advantage. Food, shops, and restrooms provide value beyond charging speed versus competing CPOs who typically install chargers without amenities.

Request dynamic pricing capabilities. Fixed premium pricing maximizes per-session revenue but suppresses volume. Adopt Tesla’s time-of-use pricing to unlock new customer segments.

Negotiate V4 hardware access. If available, choose V4 for future proof deployment.

Clarify maintenance protocols. Understand whether Tesla proactively monitors and alerts to faults or requires partner-reported issues.

Balance pricing for utilization. Very premium prices aligned with national level prices will alienate Tesla drivers. As more private owners will get EVs without home charging, they will define the higher utilization and they would require attractive prices.

What Comes Next

If the UK serves as a template, Europe could see between 500 and 1,500 partner-operated Tesla chargers within the next three years.

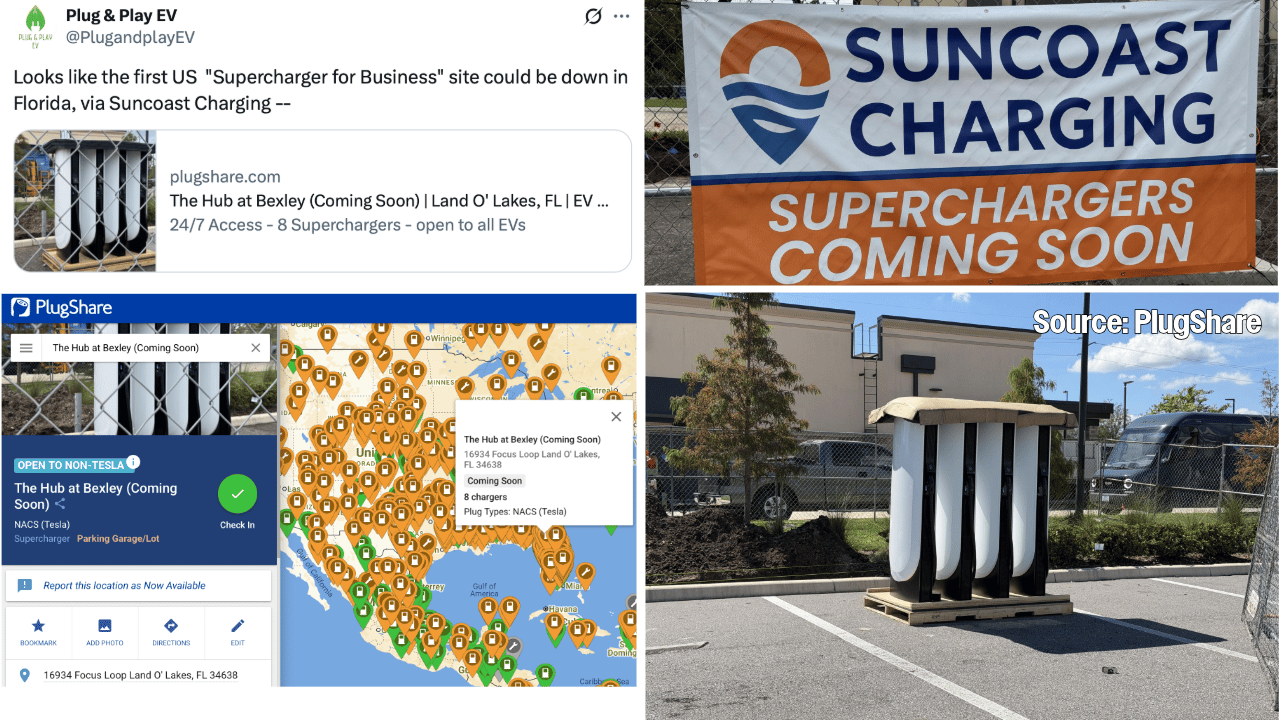

And it’s not just Europe, the model is quietly expanding to the U.S. too. Based on early filings and operator hints, the first white-label Supercharger may soon appear in Florida or Arizona.

First US white-label supercharger site spotted in Florida. Source: PlugShare

If this article performs well, my next deep dive will cover the economics behind Tesla’s white-label model, how the margins, pricing logic really work.

How To Work With Me

I'm Syed Haseeb Hassan, e-mobility analyst with 9 years of experience in the European charging and automotive sectors.

I spent 5 years at Schaeffler (Tier 1 automotive supplier) managing sales to GM, Toyota, Honda, Opel, and McLaren, then 4 years at ABB E-Mobility as Sales Manager for DC fast chargers (incl. Business Development, Service), working with operators including Shell, TotalEnergies, and Jet, plus installers and logistics clients across Germany.

My recent independent research includes:

Complete breakdown of IONITY's network scaling strategy - supplier shifts, deployment priorities by country, and exact hardware split across ABB, Tritium, Alpitronic, and Ekoenergetyka

Shell Dynamic Pricing Pilot Explained: Pros, Cons and Improvement Potential

Mercedes AMG GT XX Record Breaking Run: The Math Behind It

BMW iX3 Neue Klasse: LCA Analysis and Comparison With Other Powertrains

Need This Level of Analysis For Your Business?

Whether you’re:

Evaluating white-label opportunities (site selection, financial modelling, risk assessment)

Benchmarking competitive positioning (pricing, utilisation, customer experience)

Conducting infrastructure due diligence (technology roadmap, market-entry strategy)

I deliver research that saves you months of work and provides decision-ready intelligence.

Let's talk: [email protected]

Get Analysis Like This In Your Inbox

This report took many hours of field mapping, discussion with Tesla users and data analysis. I publish infrastructure deep-dives like this regularly, but most go to newsletter subscribers first.

Subscribe at etechvolution.com for:

Operator deployment tracking and competitive analysis

Pricing benchmarks and utilization economics

Strategic insights on charging infrastructure markets

Early access to research and datasets

Automotive Market and Trends

Thanks for reading. Let's keep pushing the conversation forward.

Haseeb